Affinity Insider | September 2025

Every choice we make, financial or otherwise, creates ripples. Some are small, like adjusting a quarterly tax payment to stay ahead. Others are larger, like deciding how to handle RSUs so they build lasting wealth instead of surprise tax bills. And sometimes, the ripples come from outside the spreadsheet entirely, like showing up at a community beach clean-up and watching your child see stewardship in action.

This edition of The Affinity Insider is about those ripples. The small, consistent actions that compound over time to shape not just our finances, but the world around us.

Here’s what you’ll find inside:

💸 Your Finances in Focus — Why quarterly tax projections matter, and how they protect cash flow, uncover opportunities, and help you avoid April surprises.

📈 Market & Investing Commentary — August’s “wall of worry,” U.S.–India trade tensions, equities near record highs, and what the seasonal backdrop means for September.

🎁 Featured Article — Turning RSUs Into Real Wealth: Avoid Regrets, Build a Smarter Plan. A practical framework for handling one of the most important (and misunderstood) parts of compensation.

📚 What I’m Reading, Watching & Listening To — A curated list on dividends, Buffett’s moats, retirement rules, and more.

🌊 Behind the Scenes — Reflections on stewardship, community, and Tikkun Olam after a beach clean-up morning with PJ Library and the Jewish Federation of Orange County.

We are grateful for the chance to be a part of the ripples you’re creating—in finances, in family, and in life.

Let’s begin.

💸Your Finances in Focus

Why We Run Quarterly Tax Projections

For many, tax season feels like a once-a-year event—gather the forms, file the return, and move on. But at Affinity, we take a different approach. We believe in running quarterly tax projections as an essential part of planning, not just filing.

Why does this matter?

1. Avoid surprises

Nobody likes an unexpected tax bill or under-withholding penalties in April. Projections allow us to adjust withholding or estimated payments early.

2. Take advantage of opportunities

By looking ahead, we can time strategies like Roth conversions, charitable giving, or harvesting investment gains/losses while there’s still time in the year.

3. Adapt to life changes

A bonus, job change, new child, or property sale can all shift your tax picture. Quarterly reviews help us respond in real time.

4. Protect cash flow

Knowing what’s coming prevents scrambling for liquidity when tax deadlines arrive.

For those with high incomes, equity compensation, liquidity events, or sizeable bonuses, quarterly projections are a must. These are the scenarios where proactive tax planning makes the biggest impact.

With greater awareness, you are empowered to pay what you owe on time, maintain enough cash for emergency reserves and near-term needs, and invest the rest for long-term growth.

Running these routine checks is one of the behind-the-scenes ways we help keep your life and finances aligned, not just at year-end, but all year long.

👉 To see if a quarterly tax check-in would benefit you, email me at derek@affinity.financial and we’ll put a plan in motion.

📈Market & Investing Commentary

Climbing the Wall of Worry

August proved to be another month of markets “climbing the wall of worry,” a phrase that describes how investors often look beyond short-term concerns, staying optimistic as long as underlying fundamentals remain supportive. Three themes stood out:

1. Inflation vs. Rate Cut Expectations

Inflation continued to run above the Fed’s 2% target, with core Personal Consumption Expenditures (PCE) near 2.7%. At the same time, softer job market data and signs of slowing growth led investors to anticipate potential rate cuts. This push-and-pull between sticky inflation and easier policy hopes was the month’s most important driver of interest rates, bonds, and stock valuations.

2. U.S.–India Trade & Diplomatic Shock

A sharp escalation in tariffs, reaching as high as 50%, between the U.S. and India unsettled global markets. This move underscored how vulnerable global supply chains remain and highlighted how quickly trade policy shifts can create both risks and opportunities for investors.

3. Equities Near Record Highs

Even with mixed economic signals, the S&P 500 gained 1.9%, returning to record highs by month-end. Investors leaned on solid corporate earnings, ample liquidity, and confidence that policymakers would step in if conditions weakened further. Abroad, international developed markets rose 4.4%, driven by attractive valuations, fiscal tailwinds, and a more balanced global growth outlook.

Looking Ahead: The Seasonal Backdrop

September has historically been one of the more volatile months for markets. The volatility index (VIX) tends to rise after reaching summer lows, with spikes frequently occurring in late September or October. Contributing factors include thinner trading volumes, key policy announcements, and corporate earnings revisions.

Staying diversified and disciplined remains the most effective way to navigate shifting conditions.

🎁Featured Article

Turning RSUs Into Real Wealth: Avoid Regrets, Build a Smarter Plan

Restricted Stock Units (RSUs) are one of the most valuable, and most misunderstood, parts of modern compensation. For many professionals, they rival salary and bonus in importance, yet too often they’re left on autopilot.

In this month’s feature article, you’ll learn about:

- Why RSUs should be treated like salary, not “extra” money

- The hidden tax traps (and how to avoid surprise bills)

- How to manage concentration risk without feeling stuck

- A simple framework to decide when to hold, sell, or reinvest

- Real-world case studies from tech professionals like you

RSUs can either be a windfall or a weight. The difference comes down to having a clear plan.

👉 Read: “Turning RSUs Into Real Wealth: Avoid Regrets, Build a Smarter Plan”

Did You Know? 👇

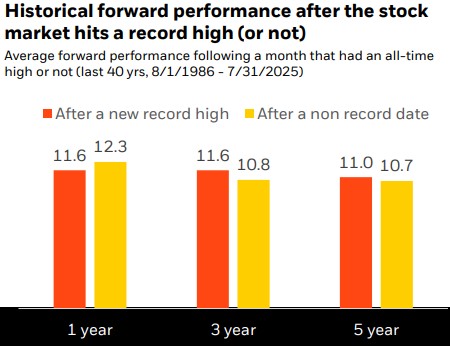

All-time highs are not rare. In fact, over the last 40 years, 36% of months have had at least one calendar day that achieved a record high in the S&P 500.

Investing at all-time highs has actually produced solid results, often not much different from investing at any random time.

More specifically, here’s how those returns compare over the last 40 years:

- 1-year holding period: 11.6% after all-time highs vs. 12.3% for ALL OTHER periods

- 3-year holding period: 11.6% vs. 10.8%

- 5-year holding period: 11.0% vs. 10.7%

Source: Morningstar and Bloomberg, U.S. stocks represented by the S&P 500 TR index.

📰🎧🍿What I’m Reading, Listening To, and Watching

💵 S&P 500 Index Dividends & Stock Buybacks (First Trust)

🏰 Buffett’s Intangible Moats (Sparkline Capital)

👑 Why be an LP when you can be a GP? (Downtown Josh Brown)

🏌️ The ‘First Year of Retirement’ Rule (Kiplinger)

🧗 How to Set & Achieve Massive Goals | Alex Honnold (Huberman Lab)

🏡Behind the Scenes

Tikkun Olam at the Beach

When you have a young child, even checking the mail becomes something to look forward to. One of the most joy-filled mail days in our home is when a new PJ Library book arrives. For those unfamiliar, PJ Library is a program that sends free, age-appropriate Jewish books to families each month. It’s a way to bring timeless stories and values into the homes of young children, something our family has loved sharing together.

This month, we joined PJ Library and the Jewish Federation of Orange County for a community beach clean-up at Salt Creek Beach in Dana Point. The Jewish Federation often circles back to a central Jewish value: Tikkun Olam—a Hebrew phrase meaning “repairing the world.” It’s the idea that each of us can play a small part in making things better.

Armed with sifters, grabbers, and some very enthusiastic kids, our group collectively filled more than half a large beach trash can. Most of what we collected was plastics and paper from food brought to the beach, a simple but powerful reminder that our everyday choices affect the environment we all share. And while the work was meaningful, it was also a chance to pause and appreciate the natural beauty around us, a gift we all have a role in preserving.

While it was a simple act, picking up litter on a sunny morning, our son got to see firsthand what it means to care for our shared spaces and to notice the little ways we’re connected.

At its heart, this is stewardship: caring for what we’ve been entrusted with, whether that’s our communities, our families, or our financial resources. Sometimes it looks like showing up as a friend, a guide, or a partner. And even when no one is watching, our actions still create lasting ripples, shaping the world for ourselves and for others.

In personal finance, we often talk about the miracle of compound interest. Stewardship works the same way. Small, consistent actions can build a legacy of care. Hopefully, one that carries forward to the next generation.

P.S. ~ What’s one small act you can take this week—whether for a neighbor, a friend, or the environment—that will leave things just a little better than you found them?

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation