Affinity Insider | November 2025

The year-end holidays have a quiet way of inviting us to notice what we’re grateful for, to revisit what matters, and to pay attention to the small decisions that add up to a meaningful year.

This edition of The Affinity Insider is about about intentional giving and purposeful planning, connecting timely decisions with the values that guide them.

Here’s what you’ll find inside:

💸 Your Finances in Focus — The most important year-end financial decisions to make now, before the window closes.

📈 Market & Investing Commentary — A grounded look at October’s rate cuts, banking headlines, gold fever, and what it means for diversified investors.

🎁Featured Article — A charitable giving framework for 2025: purposeful, tax-savvy, and aligned with your values.

📚 What I’m Reading, Watching & Listening To — Curated insights on global dynamics, inflation, markets, and long-term planning.

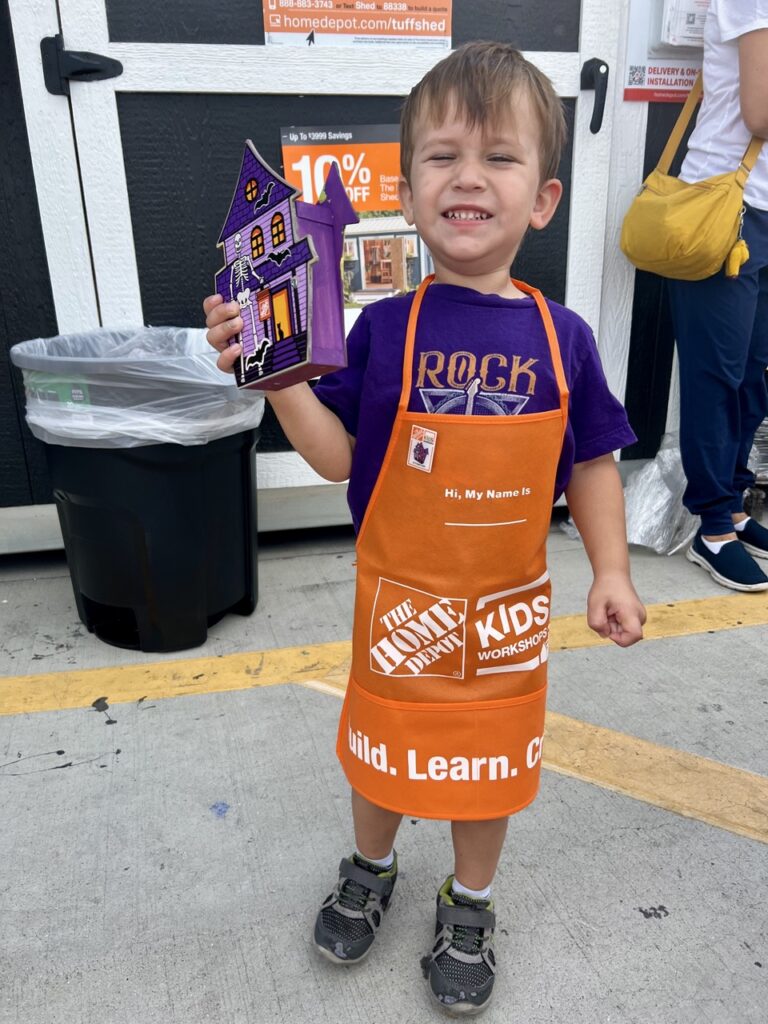

🦆 Behind the Scenes — How a preschooler, four quarters, and a rubber duck taught us something about values and choice.

As always, thank you for letting this newsletter be part of an ongoing relationship, not just a monthly update.

Let’s begin.

💸Your Finances in Focus

Year-End Planning: The Highest-Value Moves We’re Helping Clients Make Right Now

Year-end isn’t about scrambling. It’s about taking advantage of a moment in time when a few small, well-timed decisions can meaningfully shape the year ahead. Here’s what we’re focusing on with clients right now, the work that moves the needle the most.

1. Make Taxes Work For You, Not To You

Before December 31st, the tax code offers opportunities, not just obligations.

- Identify where their income will land and adjust before crossing key tax thresholds

- Use gains, losses, and deductions intentionally instead of reactively

- Plan around RSU vests, bonuses, and option exercises so surprises disappear

It’s not about tax trivia. It’s about keeping more of what you’ve earned.

2. Max Out the Accounts That Build Future Wealth

These accounts have rules—and deadlines. Used correctly, they give you a long-term edge.

- Confirm 401(k), 403(b), 457(b), and after-tax contribution opportunities

- Decide whether Roth conversions make sense this year

- Strategically “fill” lower tax brackets when income is temporarily down

The goal: use today’s tax structure to support tomorrow’s freedom.

3. Manage Investments with Intention, Not Instinct

Year-end brings both opportunities and pitfalls.

- Harvest losses (or gains) in thoughtful, evidence-based ways

- Avoid unnecessary capital-gain distributions

- Confirm RMDs, both traditional and inherited, are done correctly and efficiently

Better investment decisions aren’t louder. They’re smarter.

4. Align Generosity with Tax Efficiency

Giving is always good. Tax-efficient giving is even better.

- Donating appreciated securities instead of cash

- Bunching donations or funding a donor-advised fund to maximize deductions

- Using QCDs if over age 70½ for a win–win strategy

Give with intention. Save with intention.

5. Make Cash Flow Work Harder Before the Clock Resets

Small adjustments now prevent waste later.

- FSA and Dependent Care FSA balances to avoid losing unused funds

- Whether upcoming medical spending should happen before deductibles reset

- 529 contributions, gift planning, and education strategies

These aren’t “little things.” They’re easy wins.

6. Update the Pillars That Protect Your Family

Life changes. Documents should, too.

- Make smart decisions with company benefits, health insurance, and other policies that protect your well-being

- Review beneficiary designations and estate documents

- Ensure new laws or family changes are reflected in the plan

Peace of mind is part of the plan, not an afterthought.

7. Look Ahead to 2026 With Clear Eyes

Year-end is a moment of clarity.

We help clients connect today’s decisions to next year’s goals: retirement, home purchases, college planning, equity comp strategy, and more.

The value is not in the checklist. It’s in knowing which items matter most for you.

If you want to finish the year ahead of the curve and set up 2026 with momentum: 👉 Schedule your Year-End Quarterly Strategy Meeting

Let’s make these last few weeks count.

📈Market & Investing Commentary

A Quick Look at October

October brought a mix of progress and uncertainty as markets weighed the latest economic data against the backdrop of a federal government shutdown. While the shutdown limited the flow of fresh economic reports, the data we did receive reinforced a familiar message: the economy remains resilient, even as markets continue to experience the occasional wobble.

1. Fed Rate Cut: A Down Shift, Even With Missing Data

The Federal Reserve delivered its second rate cut of 2025, lowering the federal funds rate to 3.75%–4.00%. But with the government shutdown disrupting portions of inflation, spending, and employment reporting, policymakers were operating with less visibility than usual. Chair Powell made that clear, noting that another cut in December is possible but far from guaranteed.

2. Are Banks in Trouble? Probably Not.

J.P. Morgan CEO Jamie Dimon made headlines with a notable warning: “When you see a cockroach, there are probably more.” Referring to a handful of regional banks dealing with bad loans, he comments sparked questions about whether these issues signaled broader instability.

The caution is fair, but the broader banking system remains fundamentally strong. Industrywide loan-to-deposit ratios are near the healthiest levels since the 1970s, capital reserves are robust, and regulators’ post-2008 reforms continue to provide stability. A few isolated issues don’t point to a systemic problem.

3. Not Everything That Glitters Is Gold (Not Even Gold)

Gold has surged this year, but its long-term track record tells a different story. Since its 1980 peak, it has taken nearly 45 years for gold to generate a positive real return after inflation. Its emotional appeal endures, but history shows that gold often underperforms over long stretches. It can play a role in diversification—but not as a core growth engine.

Looking Ahead

As year-end approaches, investors will be watching whether core inflation holds steady and the labor market cools modestly once full data reporting resumes. If both trends persist, another rate cut in December is likely. But either way, cut or no cut, the economy and markets continue to show resilience. Entering the holiday season, rising consumer activity and steadier financial conditions provide a constructive backdrop for long-term investors.

As always, staying diversified and disciplined remains the most effective way to navigate shifting conditions.

🎁Featured Article

Generosity in Action: A Framework for Charitable Giving in 2025

For many families, generosity is one of the most meaningful expressions of wealth. And with new deduction limits taking effect in 2026, 2025 offers a unique opportunity to give with both purpose and strategy.

In this month’s feature, we break down how to make the most of charitable giving this year, connecting what matters most to you with tools that increase the impact of every dollar.

Inside the article, you’ll learn:

- Why 2025 is different and how upcoming tax changes affect charitable deductions

- How to use appreciated stock, Donor-Advised Funds (DAFs), and Qualified Charitable Distributions (QCDs) for efficient giving

- How to align generosity with your values, causes, and legacy

- A simple framework to evaluate charities and prioritize your giving

- Practical ways to “bunch” donations and enhance year-end planning

Whether you give regularly or want to start a more intentional practice, this guide can help you bring clarity, structure, and meaning to your generosity—this year and beyond.

Click here to read the full article.

Did You Know? 👇

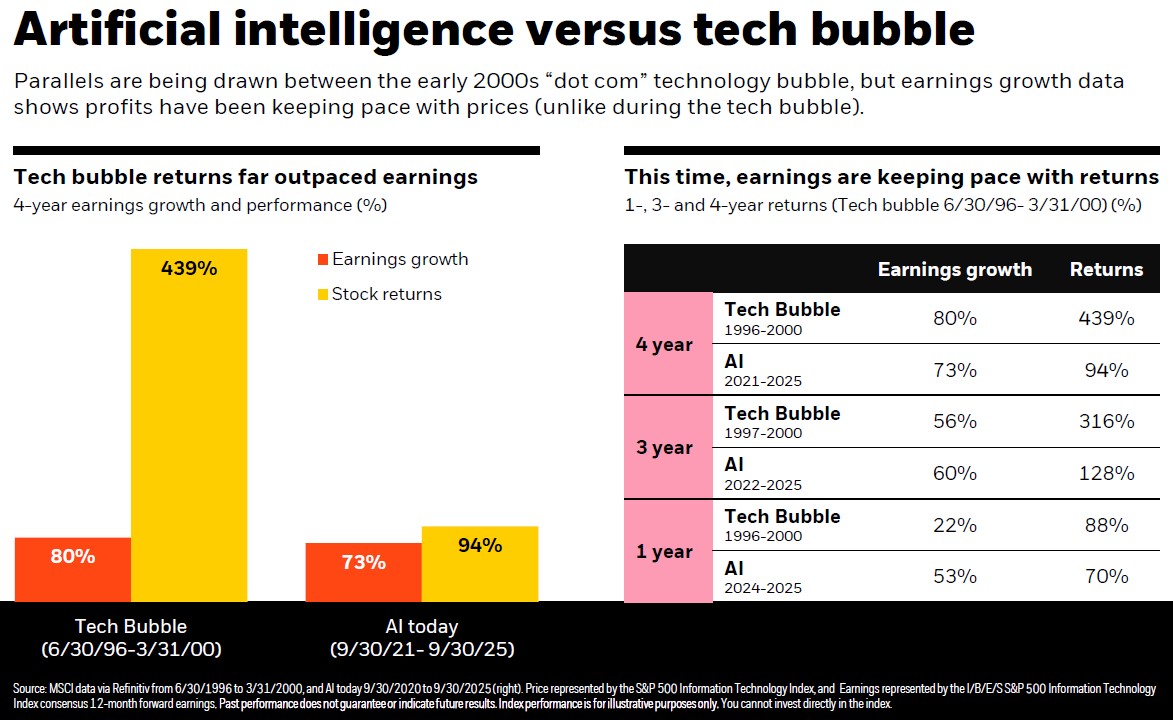

Many people are comparing today’s excitement around artificial intelligence to the tech bubble of the late 1990s, but the numbers tell a very different story.

Back then, stock prices skyrocketed even though company earnings barely grew—returns were up more than 400% over four years, while profits rose only about 80%. That disconnect is what ultimately made the bubble burst.

Today’s AI rally looks much healthier: over the past four years, AI-related companies have seen strong stock gains, but those gains are supported by equally strong earnings growth. Even over shorter one- and three-year periods, profits have kept pace with or even outpaced returns.

In simple terms, the market isn’t just “getting excited”. Many AI companies are actually earning the growth investors are paying for. This alignment between prices and profits is a key reason why today’s environment looks far more sustainable than the tech bubble era.

📰🎧🍿What I’m Reading, Listening To, and Watching

🗽 The US vs China in the 21st Century (Invest Like The Best) — A deep dive into how the geopolitical and economic rivalry between the U.S. and China will shape global innovation, supply chains, and investment opportunities in the decades ahead.

📈S&P 500 Index Earnings & Revenue Growth Rate Estimates (First Trust) —

Forward-looking expectations for corporate earnings and revenues as a guide to evaluating the strength of the current market cycle.

🫧 Why we are not in a bubble… yet (Goldman Sachs)— While valuations are elevated, today’s market still lacks the speculative excess and leverage typically seen in true bubbles.

💵 2026 Social Security Benefits To Get 2.8% COLA Bump (FA Mag)— Social Security recipients are projected to receive a 2.8% cost-of-living adjustment in 2026 to help offset inflation.

🥇 My Answers to Your Questions about Gold (Ray Dalio)— Gold’s role in a diversified portfolio and how it may behave in different macroeconomic environments.

🔄 The Force That Could Extend and End the Cycle (Talley Leger)— The structural economic drivers that could prolong the current expansion but also introduce conditions that may eventually end it.

🏡Behind the Scenes

Money Mondays and a Very Big Spending Decision

One of the best parts of parenting a preschooler is watching the world “click” for them, especially when the everyday moments start to shape how they learn. About a month ago, we introduced a new tradition in our house that has quickly become a favorite for all of us: Money Monday.

To kick it off, we gave our son a four-slot money box labeled Give, Save, Spend, and Invest, along with a sticker book so he could decorate each category in a way that felt fun and personal. We explained the purpose behind every bucket: Why giving matters, when saving helps us plan ahead, how spending is for small treats he enjoys now, and how investing works (including a simple “growth boost” where every quarter he puts in instantly earns an extra quarter). Small steps, big lessons.

Each Monday evening, he now receives four quarters and chooses at least two of the boxes to place his newfound financial resources. It’s a small habit, but one that builds values slowly and consistently. And while it’s simple on the surface, it’s been amazing to watch his wheels turn as he decides what to do.

Then came the real-world test.

Before a recent family trip to Target and the grocery store, we pulled out the fire-truck wallet full of laminated family photos. He tucked in the four quarters from his “Spend” box and proudly zipped it shut, eagerly awaiting whatever treasure he might find.

If you’ve ever walked into a Target store, there’s a section known as Bullseye’s Playground. For any preschooler, it quickly becomes a live experiment in impulse control. At first, he was drawn to the winter-themed squishy ornaments. Then he considered the kaleidoscope. The Hot Wheels clay kits had a chance, and a three-pack of race cars almost won out… until he realized it cost $3 and would require patience and another visit.

And then he spotted it: a bath-time rubber duck wearing ski goggles.

Instant clarity. Decision made.

He carried it to the checkout with total conviction, placed it on the counter, and handed over his hard-earned quarters. His money. His choice. His first true purchase, along with a beaming smile.

For my wife and I, it was a reminder that financial habits begin long before paychecks and retirement plans. They start with a dollar, a decision, and a preschooler learning that money carries meaning—and that sometimes, the best choice is the one that brings pure joy.

Even if it’s a rubber duck in ski goggles.

P.S. ~ What was your first memorable purchase as a kid? Reply and tell me. I always enjoy hearing about the small moments that shape our financial lives.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation