Affinity Insider | April 2025

Spring is often a season of renewal, opportunity, and growth—a timely moment to ask yourself: Where is your energy going? Are your time, money, and attention flowing toward the life you want to build, or simply keeping pace with what feels urgent?

This month’s newsletter is packed with insights to help you stay informed, resilient, and confident in the path ahead. Here’s a quick look at what you’ll find inside:

🌱 Your Finances in Focus – A high-level intro to direct indexing, a more personalized and tax-smart investing approach that is especially powerful during volatile markets.

📉 Market & Investing Commentary – Q1 brought a stark reminder of just how much today’s S&P 500 hinges on a handful of mega-cap stocks. Add in new global tariffs and a dramatic market whipsaw, and it’s clear: diversification isn’t just theory—it’s working. We also break down three key takeaways, from economic slowing (not stalling), to why staying invested still matters, to the quiet strength of balance and discipline.

🎯 Featured Article: “Why the Right Investment Plan Starts With Understanding Risk” – A thoughtful dive into what risk really is (and isn’t), and how your plan is built to weather volatility.

👀 What I’m Reading, Watching & Listening To – Some standout reads and episodes worth your time, from economic commentary to happiness, legacy, and life balance.

✈️ Behind the Scenes – A personal update from a recent trip to San Francisco—complete with missing luggage, toddler resilience, and a fresh reminder that the best moments are often on the other side of adversity.

💸Your Finances in Focus

Direct Indexing: Customization and Tax Savings in One Strategy

Index investing has long been a pillar of well-diversified, cost-effective portfolios. But for certain investors, there’s now a more personalized, tax-efficient way to access those same broad-market exposures: direct indexing.

Rather than owning a traditional ETF or mutual fund, direct indexing involves owning the individual stocks that make up an index, allowing for greater flexibility and enhanced tax strategies.

We’ve partnered with Vanguard Personalized Indexing because of their thoughtful approach and strong technology platform. Here’s why we’ve found this strategy particularly beneficial for clients:

- Tax-smart investing: Individual stock ownership makes it possible to harvest losses throughout the year, especially valuable during market volatility.

- Personalization: Portfolios can be tailored to align with values, exclude specific companies, or reflect concentrated stock exposure.

- After-tax performance focus: Especially for taxable accounts, direct indexing can improve long-term outcomes by minimizing unnecessary tax drag.

This approach isn’t for everyone. It tends to offer the most value for clients with:

- Taxable investment accounts

- At least $250K in investable assets

- A desire for more customization or capital gains tax efficiency

The value of direct indexing increases when markets are choppy, because volatility creates more tax-loss harvesting opportunities.

Curious if this could be a fit for you? Let’s explore how personalized indexing may enhance your strategy. Schedule a call or reply to this email to start the conversation.

📈Market & Investing Commentary

The first quarter of 2025 reminded us just how concentrated today’s stock market really is. The S&P 500 finished Q1 down about 4.3%, but here’s the surprising part: if you remove just the seven largest tech and consumer companies—the so-called “Magnificent 7”—the index would’ve actually been up 0.5%.

Nvidia and Apple alone accounted for more than half of the index’s decline, with Microsoft, Amazon, and Alphabet adding further drag. Meanwhile, international equities, bonds, and alternative investments provided meaningful ballast—delivering the benefits of diversification in real time, not just in theory.

Global headlines in April have added fuel to market volatility. The announcement of sweeping new tariffs, including a baseline of 10% on all imports and up to 46% on goods from countries like Vietnam, sent shockwaves through global markets. We saw one of the worst two-day selloffs in 75 years, immediately by an equally impressive rally.

While the magnitude of these moves has been dramatic, the pattern isn’t new. In 2018, similarly aggressive trade announcements were followed by policy softening. It’s entirely possible we’ll see further modifications, especially if the data or political pressure calls for recalibration.

🔑 Three Key Themes Worth Knowing

- Slowing Growth, Not a Recession: Despite elevated noise around policy shifts and economic uncertainty, current data points to a slowing economy—not one that is collapsing. Consumer confidence dipped and corporate earnings were revised lower, but the fundamentals remain solid. The Fed’s base case? A gentle cooling of inflation, with a couple of rate cuts possible later this year.

- Staying Invested Still Matters: High-quality companies with resilient balance sheets and strategies that limit downside participation are well-positioned to ride out this wave. The market’s short-term reactions reflect uncertainty, not necessarily long-term damage. Timing the market is nearly impossible and the market often swings wildly when uncertainty is this high. While market pullbacks often trigger a natural emotional response to ‘do something’, the data reminds us that staying invested through volatility is still one of the smartest decisions you can make. Missing just a few large ‘up days’ can have a meaningful impact on long term performance.

- Diversification Is Doing Its Job: While U.S. equities pulled back, other parts of the portfolio stepped up. This has been especially true with bonds, international stocks, and alternative investments.

The Bottom Line

Volatility like this feels loud. But beneath the noise, your plan is doing what it’s designed to do: absorb shocks, stay resilient, and position you for long-term success.

We don’t manage money based on headlines. We manage it based on your goals—through every season of the market.

Know that we’re not sitting still. Here’s what that means in practice:

- Your emergency fund and short-term goals aren’t exposed to stock market risk.

- If you’re approaching a major goal (retirement, college, home purchase, etc.), you’re likely already tilted toward bonds and cash reserves.

- If you’re in the accumulation phase, you’re continuing to buy great investments—at lower prices.

- Your portfolio remain diversified across geographies, sectors, asset classes, and styles.

- We are harvesting tax losses and continuing to invest steadily via dollar-cost averaging, time-tested ways to come out stronger on the other side.

- We rebalance and make tactical adjustments where appropriate.

- We favor quality holdings and prudent risk management.

If it would bring clarity or confidence to talk more personally, or if you simply want to check in, we’re here to help.

Otherwise, know that we are watching closely so you don’t have to carry that burden alone.

Let’s keep your strategy aligned with the goals that matter most to you.

🎁Featured Article

Why the Right Investment Plan Starts With Understanding Risk

When markets dip, it’s easy to assume something’s gone wrong. But what if discomfort isn’t the danger—it’s the cost of progress?

In this month’s feature, we explore the real definition of risk, why volatility is misunderstood, and how the right investment plan helps you stay steady—even when things get noisy.

🎢 “You don’t have to be fearless—you just have to be ready.”

👉 Read article: Why the Right Investment Plan Starts With Understanding Risk

Did You Know? 👇

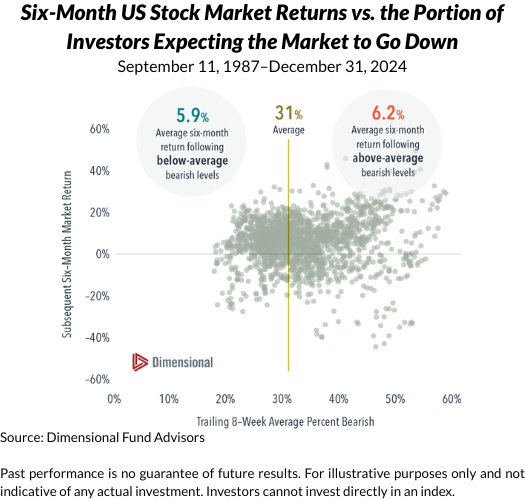

Many investors seem to be pessimistic about the direction of the market. If history is any indicator though, that’s a bad time to get out of stocks.

The American Association of Individual Investors polls its 125,000-plus members weekly on their expectations for the stock market over the next six months. The proportion expecting the market to fall is used to form a “bearish” sentiment indicator. As of February 13, the trailing eight-week average bearish percentage was about 37.7%—above the historical average of 31.0% since September 1987 and the highest since November 16, 2023.

Investors should be careful how much trust they put into these glass-half-empty views. Bearish response levels above the historical mean were followed by an average six-month US market return of 6.2%. That’s close to the average return of 5.9% following below-average bearish levels. Overall, there’s little discernable relation between the sentiment indicator and subsequent returns.

📰🎧🍿What I’m Reading, Listening To, and Watching

WEALTH

🧾 How will Trump allies pay for the Tax Cuts and Jobs Act extension? (Financial Planning)

🎢 Volatility Clusters (A Wealth of Common Sense)

💵 Scott Bessent | All-In in DC! (All-in Podcast)

💥 The AI Boom vs. the Dot-Com Bubble: Have We Seen This Movie Before? (Research Affiliates)

🪂 Anatomy of a Crisis: Tariffs, Markets and the Economy! (Aswath Damodaran)

WELL-BEING

👴 Making the Most of Financial Legacy Decisions (The Behavioral Divide)

🧑💼 The Secrets to Happiness at Work (Arthur Brooks)

🏡Behind the Scenes

We had a plan.

It involved a flight, a city I love, a long weekend of memories, and the joy of watching our almost-three-year-old experience San Francisco for the very first time—cable cars, sea lions, and skyscrapers included.

My wife was already in the city for a professional conference. The idea was simple: My son and I fly up from Orange County, meet her at the end of the week, and kick off a little family getaway. Everything was lining up perfectly.

Until it wasn’t.

My son was a model traveler, happily entertained by a surprise sticker book. But when we arrived, our luggage—and his car seat—didn’t. It had been mistakenly tagged under someone else’s name and was still sitting back in Orange County.

The airline representatives apologized, offered us replacement car seat that didn’t work, and promised the luggage would arrive on the next flight and be driven to our hotel.

In that moment, standing in baggage claim, watching my tired toddler hold up his sticker book to the airline agent like a little badge of hope, I remembered something important: We can’t always control what happens, but we can always choose how we respond.

I took a deep breath. I knew everything would be okay. I just had to take it one step at a time. And more than anything, I knew it wasn’t about fixing everything. It was about staying grounded so that my son could feel safe in an unfamiliar place.

So we carried on, took the airport train to the rental car center, and secured a vehicle and working car set. Eventually we greeted my wife, who welcomed us with a hug and a little relief.

That night, our luggage arrived—just in time to deliver our son’s favorite pajamas and sleeping blanket. But even if it hadn’t, we’d have been okay. Not ideal, maybe, but still okay.

Because what mattered most wasn’t lost.

We rode the cable car up and down California Street. We marveled at sea lions and spun around on the Pier 39 carousel. We wandered the Embarcadero, touristy and wide-eyed. We met up and laughed with long-time friends. We were there, together.

Plans are useful, but they’re just a starting point. Life—real life—happens in the space between what we expected and what actually is. And sometimes, that gap is where the best memories are made.

P.S. ~ What’s a time when your plans didn’t go as expected but something good emerged anyway?

I’d love to hear your story. Just hit reply—I always enjoy reading your notes.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation