Affinity Insider | January 2025

Welcome to the refreshed Affinity Insider.

More than just a newsletter, this is a conversation—a chance to connect, to share ideas, and to explore what truly matters when it comes to your financial life. My goal is simple: to deliver value, spark curiosity, and provide tools to help you thrive.

What’s on your mind? What financial topics are most important to you right now? What should I write about next? Hit reply and let me know—I read and respond to every message.

Let’s make this a space for clarity, growth, and insight.

Here’s to what we’ll build together.

💸Your Finances in Focus

The calendar flipped, and with it, a world of opportunity. Tax brackets shifted, contribution limits nudged higher, and Medicare premiums evolved. These aren’t just numbers—they’re your tools for building something remarkable.

The question is: will you use them?

Discover what’s changed, why it matters, and how you can act to make this your best year yet.

📈Market & Investing Commentary

As we reflect on the investment returns for 2024, it’s clear that the year provided strong returns for diversified, balanced investors who were able to tune out the noise.

Despite the initial concerns and negative sentiment surrounding the U.S. equity markets, the market defied expectations, setting new all-time highs on 57 different days—ranking as the fifth most in history. The incredibly strong equity returns, especially in the face of pessimistic predictions early in the year, underscore the importance of ignoring market noise and sticking to your investment plan.

While U.S. equity markets produced strong returns of 25%, non-U.S. equity markets continued to underperform with the total international equity market up 5%. U.S. bond markets, as measured by the Bloomberg U.S. Aggregate Bond Index, had a positive yet more muted return of approximately 1%.

We enter 2025 cautiously optimistic in our outlook. While there is still enough appreciation potential to maintain a constructive stance, it is important to be cognizant that two years of big gains suggests a lot of good news is priced into a growing number of stocks.

On the positive side, the US economy remains resilient with solid growth, historically low unemployment, and household net worth and corporate earnings reaching record highs.

Key risks include potentially persistent inflation that may surprise consensus estimates to the upside and trend higher over the next year. Additionally, markets may face challenges amid uncertainties related to near-term negative growth and labor supply disruptions caused by tariffs and border security measures. Clarity from the size and scope of any positive impacts associated with tax cuts, deregulation, and increased energy production may not be known until the back half of the year.

As always, maintaining a long-term perspective amidst short-term noise remains essential as we navigate the uncertainties ahead.

With focus and discipline, let’s make 2025 another step toward securing your financial future.

🎁Featured Article

Master Your Finances with These 10 Key Numbers

Most people think managing money is about tracking every penny, agonizing over spreadsheets, and feeling guilty about that latte.

It’s not.

Real financial clarity comes from focusing on the numbers that matter most—the ones that create real progress.

In this article, I’ll show you the 10 essential numbers that can simplify your finances and help you build a strategy that works on autopilot.

No jargon. No overwhelm.

👉 Read “Master Your Finances with These 10 Key Numbers” and start mastering your money today.

Your future self will thank you.

Did You Know? 👇

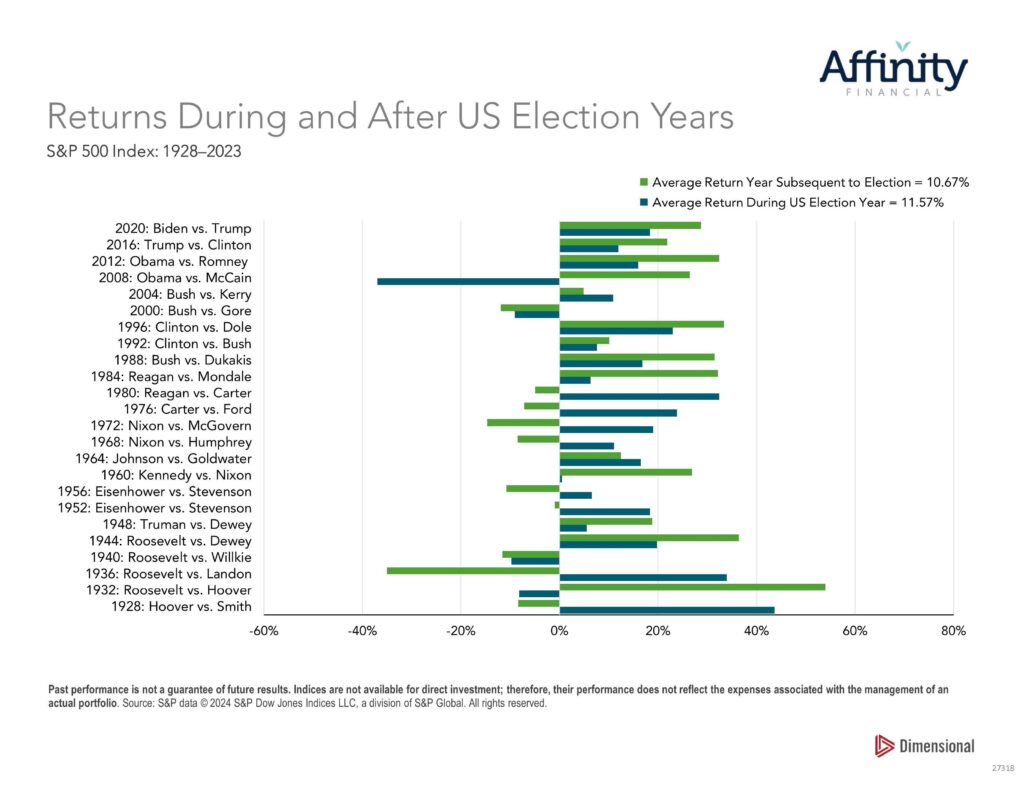

On average, market returns have been positive both in election years (11.57%) and the subsequent year (10.67%).

📰🎧🍿What I’m Reading, Listening To, and Watching

WEALTH

🤔 What Investors Expect from Trump (Goldman Sachs)

🙃 2024 Market Forecasters’ Report Card (Avantis Investors)

⚙️ Outlook 2025 Edition: Long-term perspective on markets and economies (Capital Group)

⚡ Top Risks for 2025 (Eurasia Group)

💀 Warren Buffett suggests all parents do one thing before they die (CNBC)

WELL-BEING

❓ Why Do You Do What You Do? Because You Better Know. (Ryan Holiday)

😁 Compromise to Optimize Happiness in Life’s Domains (Meaningful Money)

👶 Dr. Becky Kennedy — Parenting Strategies for Raising Resilient Kids (The Tim Ferris Show)

💪 Nir Eyal — How To Become An Indistractable Force (Infinite Loops)

🍀 The 4 Types of Luck (Sahil Bloom)

🏡Behind the Scenes

December was a month of trains.

Not the kind that run on schedules, but the one my 2.5-year-old son, Caleb, dreamed of. A red train, his holiday wish. He got it, along with other treasures—but that train? Pure magic.

The season brought celebrations across California and Colorado, moments filled with family, gratitude, and love. A reminder of why we show up every day—in work and in life—to create, to contribute, and to care.

I hope your year ended with meaning, joy, and connection. Cheers to health, happiness, and the adventures ahead in 2025!

P.S. ~ I’d love to hear about your top moments from this past year—big or small. Drop me a note or a picture; it’s always inspiring to celebrate life’s highlights together!

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation