2025’s Big Tax Shake-Up: Your Practical Guide to the One Big Beautiful Bill Act (OBBBA)

What It Means for Your Taxes and How to Plan Ahead

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law, bringing sweeping changes to the tax code.

Many of these provisions create new opportunities but also new pitfalls, especially because more deductions and credits are now tied to Modified Adjusted Gross Income (MAGI). Strategic coordination of income, deductions, and timing has never mattered more. For example:

- A family nearing the State and Local Tax (SALT) deduction threshold could benefit from carefully timed income or deductions to preserve the full $40,000 deduction.

- A Roth conversion might look smart, until it pushes you over a Modified Adjusted Gross Income (MAGI) threshold and disqualifies you from the new senior deduction.

- A business owner’s bonus depreciation strategy may need to be accelerated before the next phase-out begins.

Some benefits are permanent, but many expire between 2025 and 2029. Between now and 2028, when many of these temporary provisions are slated to sunset, tax planning is getting more complex, but also more powerful. Smart, multi-year planning can lock in advantages before they disappear.

Whether you file taxes as an individual, family, retiree, or business owner, OBBBA will impact your finances across taxes, retirement, business operations, and estate planning.

Let’s highlight key provisions, and break it down with relatable examples and practical planning tips.

What’s Permanent: The New Normal

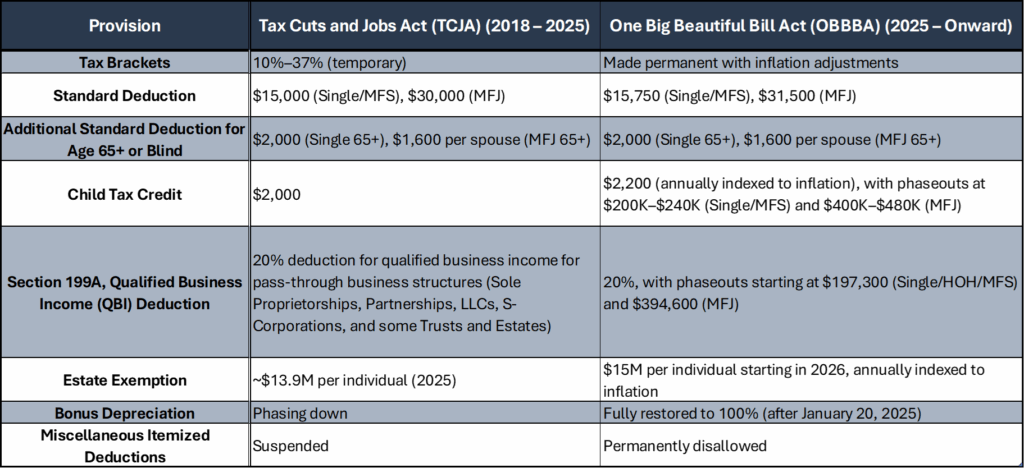

While many OBBBA provisions are temporary, several major tax rules are now permanent. The table below highlights the key “new normal” provisions and how they compare to pre-2025 law.

🌐 For All Taxpayers

A number of provisions affect a wide range of taxpayers regardless of age or profession.

Key Universal Provisions

🏴State and Local Tax (SALT) Deduction (2025–2029)

For those itemizing deductions, the deduction cap on state and local taxes (SALT) temporarily increases to $40,000.

- Phaseout: Begins at $500,000 MAGI and reduces down to a minimum of $10,000 by $600,000 (Single/MFJ/HOH).

- The phaseout cap increases at 1% per year through 2029, but reverts to the $10,000 cap in 2030.

- The increase in the SALT deduction will most likely lead to an increased number of taxpayers who will benefit from the ability to itemize deductions beyond the standard amount.

🎗️Charitable Giving Deductions for Standard Deduction Filers (2026-2029)

Above-the-line deduction for cash gifts to qualified charities, up to $1,000 (Single) or $2,000 (MFJ), even if you don’t itemize.

- Qualifying charitable contributions must be in cash (i.e., no other types of property like household goods or securities). Additionally, contributions cannot be made to Section 509(a)(3) “supporting organizations” or used to establish or maintain a donor-advised fund.

🫶Charitable Giving Deductions for Itemized Deduction Filers (2026+)

For the first time, itemized charitable gifts must exceed 0.5% of AGI to be deductible.

- If a charitable contribution exceeds the upper AGI limits for that contribution type and part of the deduction is carried over to the following year, then any of the 0.5%-of-AGI floor attributable to that contribution type is also carried over.

🏠Mortgage Insurance Premium Deductions for Itemized Deduction Filers (2026+)

In addition to retaining the $750,000 personal residence indebtedness limit and acquisition indebtedness requirements, mortgage insurance premiums are restored as deductible.

🍴Qualified Tips Deduction (2025–2028)

For taxpayers that work in an occupation that “traditionally and customarily” received tips prior to 2025, up to $25,000 can be excluded from federal income taxation.

- Phaseout: $150,000–$400,000 (Single), $300,000–$550,000 (MFJ).

- Income from tips is still subject to payroll tax, included in AGI, and may also be subject to state income tax.

🏥Qualified Overtime Deduction (2025–2028)

Qualified overtime compensation can be excluded from federal income taxation, up to $25,000 (MFS) or $12,500 (Single/HOH/MFS).

- Phaseout: $150,000–$400,000 (Single), $300,000–$550,000 (MFJ).

🚗Auto Loan Interest Deduction (2025–2028)

Up to $10,000 per year deductible for new car loans (not leases) on U.S.-assembled vehicles.

- Phaseout: $100,000–$150,000 (Single), $200,000–$250,000 (MFJ).

🚌K-12 State Scholarship Donation Credits (2027+)

Tax credit of up to $1,700 for contributions to charitable organizations that fund K–12 scholarships within their state.

Case Study: Alex & Jordan – Reversing SALT Phaseout Impact

Alex and Jordan expect $540,000 in MAGI and $38,000 in state and local taxes. In the SALT phaseout range, they would lose $16,000 of deductions — costing them about $7,200 in extra federal tax. Working with their advisor, they reduce MAGI below $500,000 by maximizing retirement plan contributions, using HSAs and a Dependent Care FSA, harvesting capital losses, moving high-income investments into retirement accounts, and bunching charitable gifts into a donor-advised fund. This preserves the full SALT deduction and avoids the $7,200 tax hit.

📌 Planning Tip: Reduce MAGI to preserve SALT deduction

Near the $500K–$600K SALT phaseout? Reduce MAGI with retirement contributions, HSAs, FSAs, and strategic charitable timing to avoid steep marginal rate spikes.

Case Study: Jamal & Tess – Claiming Tax Benefit from Charitable Giving

Jamal and Tess typically give $10,000 to charity annually. Their advisor flagged the 0.5% of AGI floor for itemized gifts starting in 2026. They accelerated multiple years’ giving into 2025, contributing highly appreciated stock to a donor-advised fund (DAF), and preserved an extra $8,000 in deductions.

📌 Planning Tip: Accelerate or Bundle Charitable Gifts

For high-income taxpayers who plan to make charitable contributions, it may be best to do so in 2025 before the 0.5%-of-AGI floor takes effect in 2026. A donor-advised fund can lock in the deduction now while allowing flexibility on when the funds are granted to charities.

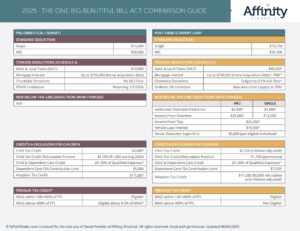

For a high-level overview of many of the key OBBBA tax law changes, check out:

👨👩👦 For Families, Parents, and Savers

Several provisions increase the value of benefits for families, but income phaseouts can reduce or eliminate them if not planned for carefully.

Key Family Provisions

🚸Child Tax Credit (2025+)

Tax credit of $2,200 per child, with inflation adjustments in future years.

- Phaseout: $200K–$240K (Single), $400K–$480K (MFJ).

👶Adoption Credit (2025+)

Now partially refundable up to $5,000, providing actual cash benefits even to families with limited tax liability, indexed to inflation starting in 2025.

🧑🎓Student Loan Support from Employers (2025+)

Employers can now contribute up to $5,250 per year toward employees’ student loans, tax-free, with annual inflation adjustment beginning in 2027.

🎁529A ABLE Account Contributions (2025+)

Extension of the 529A ABLE account rules allowing contributions up to the current gift exclusion limit plus the beneficiary’s compensation up to the Federal poverty line.

⚕️Health Savings Account Expanded Eligibility (2026+)

The definition of a High Deductible Health Plan (HDHP), which an individual must have to contribute to a Health Savings Account (HSA), expands to include all “Bronze” and “Catastrophic” plans offered on Federal or state Affordable Care Act exchanges.

- In 2025, the maximum contribution is $4,300 (Single) or $8,550 (MFJ) with a $1,000 allowable catch-up contribution for those age 55+.

- A Health Savings Account (HSA) is a triple tax-advantaged savings account that can be used to pay for qualified medical expenses.

🎒Dependent Care Flexible Spending Account (2026+)

Pre-tax benefit account used to pay for eligible dependent care services increases annual contribution limit to $7,000.

🏫529 Education Savings Plans (2026+)

Tax-advantaged 529 education accounts can now cover more K–12 and homeschooling costs and special education, enhancing your educational planning options.

- Starting in 2026, the annual limit for these K-12 expenses increases from $10,000 to $20,000 per year.

- Newly established eligible uses include: Curriculum & instructional materials, books & digital educational content, tutoring & extracurricular educational classes, testing fees (e.g. AP, SAT), post-college credentialing, and educational therapies & adaptive tools.

🧑🏫Educator Expenses for Itemized Filers (2026+)

Educator expenses become their own itemized deduction, allowing educators to potentially deduct more of their unreimbursed out-of-pocket costs for educational materials and supplies.

🏦Trump Accounts (2026+)

This innovative new tax-advantaged account for minors combines features of traditional and Roth IRAs.

- One-time $1,000 government contribution for children born 2025–2028.

- $5,000 annual contribution limit, with employer matching up to $2,500 annually.

- The proceeds must be invested in a low-cost index fund tracking a major index like the S&P 500, and the funds are untouchable until the child turns 18.

- Unlike IRAs, contributions to a Trump account are not tax deductible. Earnings grow tax-free and distributions will be taxed as the generally lower long-term capital gains rate of 15% to 20%.

Case Study: Maria & Leo – New Parent Tax Savings

Maria and Leo welcomed a baby in 2025. In 2026, they opened a Trump Account to receive the $1,000 government contribution, took advantage of the expanded $2,200 Child Tax Credit, and and shifted childcare costs into the now-expanded $7,000 Dependent Care FSA, earning a net tax savings of $2,100.

📌 Planning Tip: Maximize Child Credits & Tax-Advantaged Accounts

If you’re expecting or raising kids, plan ahead to maximize Child and Dependent Care credits and tax-advantaged accounts like Dependent Care FSAs, Health Savings Accounts, Trump Accounts, and 529 College Savings Accounts. Year-by-year coordination with your advisor can lead to real savings and multi-generational wealth building.

👵 For Retirees and Near-Retirees

The law introduced new deductions for older Americans, but these come with income limits. That makes coordination between retirement income sources and timing even more essential.

Key Retiree Provisions

👴Senior Exemption (2025 – 2028)

New deduction of $6,000 for seniors age 65+, in addition to the regular age 65+ deduction ($1,600 per married spouse, $2,000 single).

- Phaseout: $75,000–$175,000 MAGI (Single), $150,000–$250,000 (MFJ).

🪪Social Security

Tax treatment on Social Security unchanged, however, qualifying for larger Senior deductions or SALT and Charitable Deductions may reduce net tax liability.

- Phaseout: 0% rate if MAGI below $25,000 (Single) or $32,000 (MFJ), 50% if between those amounts and $34,000 (Single) or $44,000 (MFJ), and 85% if above those amounts.

🧑⚕️Affordable Care Act (ACA) “Subsidy Cliff” (2026+)

Households over 400% of the federal poverty line lose all ACA premium subsidies. Even $1 over the limit could mean thousands more in premiums.

Case Study: George – Senior Exemption Loss

George, age 68, converted $50,000 to a Roth IRA in early 2026, thinking it would save taxes in the long run. But the extra income raised his MAGI to $179,000, disqualifying him from the full $6,000 senior deduction. That cost him nearly $1,500 in extra taxes. In future years, he’ll convert smaller amounts in coordination with his advisor’s guidance.

📌 Planning Tip: Be Aware of Senior Exemption and IRMAA Thresholds

Coordinate Roth conversions, investment income and withdrawals, capital gains or loss harvesting, and Social Security start dates to maximize deductions like the Senior Exemption, and minimize Social Security taxation and Medicare Income-Related Monthly Adjustment Amount (IRMAA) surcharges.

Want to see how these new rules play out in your own numbers?

We can model your income, deductions, and phaseouts under OBBBA to pinpoint opportunities and avoid costly surprises.

💼 For Business Owners and Self-Employed

From bonus depreciation to expanded QBI rules, new tax legislation brings new opportunities for business owners, especially those who plan ahead.

Key Business Provisions

👔Section 199A, Qualified Business Income (QBI) Deduction (2026+)

Eligible business owners can deduct up to 20% of the lesser of their QBI from qualifying pass-through businesses or their total taxable income (minus net capital gains).

- Phaseout: $197,30 – $272,300 (Single/HOH/MFS); $394,600 – $544,600 (MFJ)

🎁Reporting Limits For Business Payments (2026+)

Increases the threshold of $600 for information reporting of business payments (1099-NEC, 1099-MISC, etc.) to $2,000, adjusted for inflation.

🏢100% Bonus Depreciation (2025+)

Qualified property placed into service after Jan 19, 2025 is eligible to take deduction of 100% of cost in the first year. Be sure to understand how future recapture could impact your tax bill.

🏘️Section 179 (2025+)

Businesses can deduct up to $2.5M of qualifying assets placed into service. The deduction phaseout threshold increased to $4M.

🧾Pass-Through Entity Tax (PTET)

Business owners can still use PTET as a SALT cap workaround by structuring their state tax payments as a fully deductible business expense.

💸Section 1202, Qualified Small Business Stock (QSBS) Capital Gain Exclusion (2025+)

Greater exclusions on qualified small business stock, beneficial for entrepreneurs and investors considering early exits or gifting.

- Each taxpayer can sell QSBS stock tax-free up to the greater of $15M, annually inflation-adjusted, or 10x original investment.

- Tiered gain exclusion applies for new stock issued after July 4, 2025: 3 years = 50%, 4 years = 75%, and 5 years = 100%.

⚠️Alternative Minimum Tax (AMT) Exemption (2026+)

The AMT exemption phaseout thresholds will be reduced to $500,000 for single filers and $1 million for joint filers. The result will be to moderately increase the likelihood of AMT exposure for certain taxpayers.

- To trigger AMT liability, single filers with between $100,000 and $200,000 of regular taxable income will need between $40,000 and $60,000 of AMT adjustments. These most commonly include the standard deduction, state and local taxes, and the difference between exercise price and fair market value on exercised Incentive Stock Options (ISOs).

- For married couples, the greatest risk of AMT exposure is between $300,000 and $500,000 of taxable income.

💪Qualified Opportunity Zone Funds (QOFs):

Opportunity Zones made permanent, allowing individuals to continue investing appreciated investment property (e.g., stocks, funds, or real estate), defer gains, and qualify for tax-preferred or tax-free growth upon meeting certain holding period requirements.

Case Study: Priya – Business Owner Income Planning

Priya runs her own business as an S-Corporation. In 2025, she worked with her advisor to set her wages just high enough to maximize a $70,000 Solo 401(k) contribution, while keeping the rest as pass-through income to fully benefit from the 20% Qualified Business Income (QBI) deduction. She also purchased needed equipment and took advantage of 100% bonus depreciation. Together, these steps reduced her taxable income by over $115,000 and saved her roughly $36,000 in federal taxes, money she reinvested back into her business.

📌 Planning Tip: Enhance Your After-Tax Income

Self-employed business owners can often fine-tune reasonable wages, retirement plan contributions, and business deductions to manage taxable income, maximize the QBI deduction, and stay within favorable tax brackets. Coordinating these levers year-by-year can produce five- and even six-figure tax savings while freeing up more cash to reinvest in the business or enhance personal well-being.

Case Study: Taylor – Employee Stock Options & QSBS Planning

Taylor joined a start up in 2025 and received Incentive Stock Options (ISOs). After confirming the company met QSBS requirements, Taylor early-exercised the options via 83(b) election options to start the 5-year QSBS holding period while shares were at a low value. Over time, Taylor coordinated with the company and their advisor to maintain QSBS eligibility, documented the acquisition date, and avoided disqualifying transactions. By 2030, Taylor could sell the shares with a 100% federal capital gains exclusion, saving over $400,000 in taxes. In addition, he is considering gifting a portion of shares into a non-grantor trust to multiply the tax-free benefit within IRS rules.

📌 Planning Tip: Optimize QSBS

Founders, angel investors, and key employees now have more levers to pull in order to qualify for QSBS exclusion from capital gains. Optimal results require attention to entity structure, documentation, acquisition dates, and holding periods. QSBS “stacking” via properly drafted non-grantor trusts can multiply the exclusion, but compliance with IRC 643(f) anti-abuse rules is essential.

Energy & Vehicle Credits Are Expiring Soon

Energy and EV-related tax credits are generous but temporary. Most begin phasing out in 2025 or 2026, making this the last window to act.

Expiring Credits

🔌Electric Vehicle (EV) Tax Credits (ends September 30, 2025)

Up to $7,500 tax credit for qualified new EVs and $4,000 for used EVs.

⚡Energy Efficient Home Improvement Credits (ends December 31, 2025)

Up to $1,200 toward the cost of energy-efficiency improvements (e.g., windows, doors, insulation, or heating and cooling equipment, and home energy audits).

☀️Residential Clean Energy Credits (ends December 31, 2025)

Up to 30% tax credit for solar, wind, geothermal, battery storage, and other renewable energy systems.

🔋Alternative Fuel Vehicle Refueling Property Credit (ends June 30, 2026)

Up to $1,000 for electric vehicle charging equipment installed at a taxpayer’s personal residence.

Case Study: Sam & Jennifer – Homeowner Energy Credits

Sam and Jennifer wanted to install solar in 2026, but after reviewing the timeline, they pulled the trigger in 2025. Doing so allowed them to capture the full 30% Residential Clean Energy Credit before it expires, saving them nearly $11,000 on their solar and battery system.

📌 Planning Tip: Act Soon on Energy Incentives

Act now on EV purchases, solar installations, and energy-efficient home improvements. Most incentives expire by the end of 2025 and likely won’t return soon.

✅ Final Takeaways

- Know Your Thresholds: Develop year-by-year income management strategies if approaching critical income range trigger phaseouts. Many benefits vanish quickly once gross income crosses a phaseout line.

- Act While You Can: Utilize time-sensitive opportunities for several big-ticket deductions that expire soon.

- Plan Multi-Year: The best OBBBA tax strategies often span several years. Long-term planning opportunities are abundant with new and expanded use account types, business deductions, gifting strategies, and estate and lifetime gifting thresholds. Many opportunities (like Roth conversions, charitable giving, or depreciation) are most powerful when viewed across a multi-year horizon.

Your OBBBA Game Plan: Lock in Opportunities, Dodge the Pitfalls

The new tax law offers big wins — if you plan ahead. Knowing your income thresholds, acting before deadlines, and mapping out a multi-year strategy are key to keeping more of what you earn.

At Affinity Financial, we can help you:

Ready to better understand how these changes affect your financial picture? Let’s talk.

Disclaimer: This article is for general informational purposes only and is not intended to provide, and should not be relied on for, legal, tax, or accounting advice. Please consult a qualified estate planning attorney or tax advisor regarding your individual circumstances.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation