Turning RSUs Into Real Wealth: Avoid Regrets, Build a Smarter Plan

The Double-Edged Sword of RSUs

Restricted Stock Units (RSUs) have become a cornerstone of compensation at many of today’s leading companies. They’re especially common in technology, biotech, and finance, where employers use them both to reward employees and encourage retention.

For many professionals, RSUs are not just a nice add-on. In fact, they can be one of the largest drivers of total compensation, sometimes rivaling salary and cash bonus combined.

At their best, RSUs can create real financial momentum.

At their worst, they can lead to surprise tax bills, overexposure to a single stock, or years of holding equity that doesn’t align with your goals.

The outcome depends on whether you turn them into a thoughtful strategy or let them happen by default.

What Exactly Are RSUs?

An RSU is a promise from your employer to grant you shares of company stock once certain conditions are met. The most common condition is time: the longer you stay, the more shares vest and officially belong to you.

Employers issue RSUs for three key reasons:

- Alignment: Your financial rewards rise when the company’s stock does

- Retention: Since shares vest over time, they encourage employees to stay

- Compensation Power: RSUs can significantly increase your overall pay beyond traditional salary, making offer packages more competitive

When the shares vest, you pay taxes on them as if they were a cash bonus. The twist is that you’re not given cash, you’re given stock.

This creates an important question: If this bonus were paid in cash, would you turn around and immediately buy company stock with it?

For many employees, the honest answer is no. Yet, because the default form of payment is stock, people often treat it differently than they would a cash bonus.

Seeing RSUs as just another form of compensation, not a bonus or a gamble, helps you make clearer decisions about whether to hold, sell, or diversify.

The Challenges That Come With RSUs

RSUs are valuable, but they bring challenges across several dimensions of financial life:

💸Cash Flow & Tax

Confusion About RSU Taxation

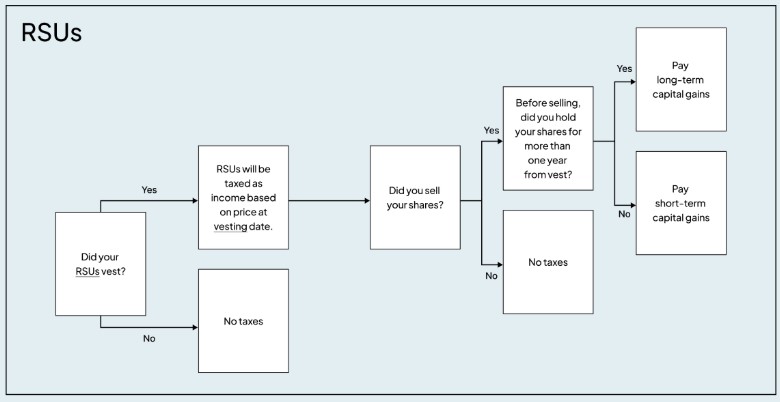

RSUs are taxed as ordinary wage income immediately at vesting. From that point forward, any growth or loss is treated like any other stock: short-term capital gains/losses if held less than a year, or long-term capital gains/losses if held more than a year.

Under-Withholding on Taxes

Federal withholding on supplementary income, like RSUs, is typically withheld at a 22% statutory rate (or 37% once supplemental income exceeds $1M). Some states have their own mandatory withing rates, like California (10.23%), New York (9.62%), or Massachusetts (5.00%). In other words, these “one-size fits all” required tax withholding rates are almost certain to be too high or too low for your particular situation. Naturally, high earners tend to be in higher Federal tax brackets, so they often discover that actual tax liability is far above these default rates, leading to unplanned, surprise, tax bills at tax preparation time. To make matters worse, the bill may be increased when under-withholding comes with additional penalties and interest. For these reason, a quarterly tax projection is prudent to determine if:

- You are on track to meet tax withholdings needs, or

- A withholding adjustment should be made through your employer, or

- Timely quarterly estimated tax payments need to be paid.

Tax Reporting Complexities

Sales show up on Form 1099-B. If the cost basis is incorrectly listed as $0, you may pay tax twice unless you obtain the supplemental tax statement that identifies the purchase price that was paid as W2 wage income.

Thinking of RSUs as ‘Extra’ Instead of Compensation

RSUs often feel like found money, separate from salary. But that mindset leads to casual decisions — overspending, overconcentration, or letting shares sit idle. In reality, RSUs are part of your pay. A dollar from equity is no different than a dollar from your paycheck, and it deserves the same intentional planning. Integrating RSUs into your budget and long-term goals ensures they accelerate progress rather than create risk.

Case Study: Why Mandatory Tax Withholding May Not Be Enough

A Microsoft product manager living in California has $100,000 worth of RSUs vest in a single year. By default, the employer automatically withholds $22,000 (22%) for federal tax and $10,230 (10.23%) for California state tax, a total tax withholding of $32,230.

Since married filing jointly with total household taxable income of $700,000, they fall into the 35% federal tax bracket and 9.30% California tax bracket. As such, actual tax liability on this $100,000 of income may be closer to $44,930. That’s a $12,700 shortfall owed at tax time.

Since the goal is for zero tax surprises, the solution is to run quarterly income and tax projections, set aside additional cash, sell enough shares, and make timely estimated quarterly tax payments to cover any gaps.

📌 Planning Tip: Don’t rely on default tax withholding

The rate you pay in your income-tax bracket may be higher than the tax withholding amount for your grant, especially if income spikes with the vesting of your shares. Get ahead of the game by preparing a projected tax return to see the impact of vesting RSUs on your tax return. Consider ways to defer other income and/or increase deductions to reduce the spike in your taxable income. For example, increase 401(k) contributions, participate in a nonqualified deferred compensation plan, make bigger charitable donations, or separately increase salary withholding.

📉Financial Risk

Overconcentration in Company Stock

Between RSUs, ESPP, and stock options, it’s common to see 50–70% of non-retirement investments tied to one single employer. This creates “triple exposure”: salary, benefits, and investments all hinge on the same company. The catastrophic risk is that you could lose everything, quickly, if company fortunes turn around. Employees often have default settings to acquire shares, but lack a strategic system to unwind exposure.

Unclear Strategy for Proceeds

Without a plan, RSUs may sit idle in cash, drift into lifestyle upgrades, or remain as concentrated stock.

Case Study: Diversifying Without a Hefty Tax Bill

A Meta marketing leader wants to reduce a large company stock position but is worried about the potential tax bill from selling.

By shifting excess cash and newly vested RSU income into a taxable brokerage account using a direct indexing strategy, they are able to harvest $40,000 of losses in other holdings, maintain diversified growth, and offset gains from strategic RSU sales. This allows them to bring company stock exposure down from 55% of net worth to 20% in under two years.

The result is higher after-tax wealth, a more balanced investment mix, and greater confidence that their family’s financial fortunes are no longer tied so heavily to one stock.

📌 Planning Tip: Consider tax-loss harvesting strategies such as direct indexing or tax-aware long/short portfolios

For high-income households, making taxable brokerage investment accounts tax-efficient is critical. Strategies like tax-loss harvesting through direct indexing or tax-aware long/short portfolios can capture losses elsewhere in your portfolio, offsetting gains from RSU sales. This not only helps manage concentration risk but can actually lower your overall tax bill, without sacrificing long-term performance potential.

😰Emotional Uncertainty

Behavioral Traps

Selling shares without a clear plan can be fraught with mental pressure to not “do it wrong.” This may come in the form of:

- Fear of missing out: Worrying that the stock price will surge right after you sell

- Anchoring: Comparing your sale to the stock’s all-time high, instead of your real goals

- Peer pressure: Feeling judged by colleagues who chose to hold or sell differently

- Herd mentality: Simply copying what “everyone else” at your company seems to be doing, without questioning whether it fits your financial needs

📌 Planning Tip: Create a rules-based selling framework

Take emotion out of the equation by creating a rules-based selling framework. Identify priority goals (home, education, retirement), then establish a preset plan that empowers near-term goals and long-term growth. Documenting the “why” behind each decision makes it easier to follow through when market noise or peer sentiment creeps in.

Case Study: Overcoming Anchoring with a Goal-Based Plan

A Box, Inc. engineer found themself anchored to the company’s prior stock highs and buoyed by optimism shared among colleagues. Selling felt risky – what if the stock value bounces quickly right after a sale?

But when they took a moment to step back and review personal goals, a home down payment and education savings for their two young children, the picture became clearer. They realized that there would always be uncertainty about the future stock price, but that was largely out of their control. Instead, they stuck to a rules-based strategy, pre-determining how much of each vest to sell immediately for family priorities and long-term diversified growth, while retaining a smaller portion to participate in potential upside.

No longer reacting to stock price swings or peer sentiment, they gained a sense of balance: opportunity without overexposure, security without regret.

🚦Restriction & Control

Blackout Periods and Trading Windows

Many companies restrict when employees can sell, often around earnings announcements.

Vesting Schedules You Don’t Control

The company determines when and how shares are delivered, not you.

Uncertainty of Future Grants

New RSUs are not guaranteed indefinitely. Employers can adjust the size or frequency of new grants at any time, adding uncertainty to long-term income and lifestyle planning.

Case Study: Preparing for Uncertain Future Grants

A sales professional at ADP earns a meaningful portion of their income through RSUs and had grown accustomed to steady, generous grants each year. While upbeat about the company’s future, they also want to prepare for the possibility that future grants could shrink or disappear altogether.

When witnessing colleagues making major lifestyle decisions on the assumption that equity income will always rise, they opt to take a more pragmatic approach. By treating RSU income as variable, not guaranteed, they adjust core lifestyle expenses to meet a more sustainable baseline of income covered comfortably from a salary alone. This frees up RSU proceeds to be earmarked for higher-value goals, like memorable family vacations family and accelerated financial independence. Rather than worrying whether the next grant cycle would meet ever-expanding lifestyle needs, they had confidence that their family’s financial well-being was secure even if RSUs became less generous, and they could still enjoy the upside when equity income was strong.

📌 Planning Tip: Avoid building your lifestyle on RSUs as if they’re guaranteed

Stress-test your plan by separating core expenses (covered by salary) from variable or aspirational expenses (funded by RSUs). Proceeds from equity can then be directed toward wealth-building goals — paying down debt, building reserves, or long-term investing — while keeping your lifestyle resilient even if future grants shrink.

Common Mistakes (and Fixes)

🧾Tax & Reporting Mistakes

Mistake 1: Relying on Default Withholding

Fix: Calculate your actual tax liability and set aside additional funds or adjust withholding before tax day.

Mistake 2: Missing quarterly tax estimates

Fix: Partner with your advisor or CPA to project and pay estimates after major vesting events.

Mistake 3: Feeling Stuck Because Selling Creates Too Much Tax

Fix: Consider the use of tax-aware strategies to reduce or eliminate the tax impact of selling highly appreciated stock. For example, direct indexing or tax-aware long/short strategies can help harvest losses in other parts of the portfolio, which can offset gains created when selling company stock. For those charitably inclined, another option is to donate shares directly to charity, which avoids the capital gains tax entirely while still providing a charitable deduction. Both approaches allow you to diversify more effectively without feeling trapped by the tax impact.

Mistake 4: Assuming RSU income is taxed only in your current state of residence

Fix: RSUs are typically sourced to where you worked while they were earned. If you move between states, your RSUs may be subject to tax in both the old and new state, requiring prorated allocations.

Mistake 5: Ignoring the supplemental 1099-B tax form

Fix: Always confirm cost basis. If you see $0, request your broker’s supplemental form to avoid double taxation.

🗃️Process Mistakes

Mistake 6: Not Knowing Your Vesting Schedule

Fix: Put vesting dates on your calendar. Treat them like paydays (because they are).

Mistake 7: Forgetting blackout periods

Fix: Blackout periods exist to prevent insider trading and align employee stock transactions with regulatory compliance. Learn your company’s trading windows, and consider a 10b5-1 plan to automate and pre-authorize sales. You can also modify vesting elections to make sure proceeds align with your personal financial objectives, giving you both compliance and clarity.

☣️Risk Management & Behavioral Mistakes

Mistake 8: Failing to coordinate with other benefits

Fix: Align RSUs with ESPPs and stock options. Together they can create much more exposure than you realize.

Mistake 9: Letting Concentration Run Wild

Fix: While personal circumstances vary, a practical benchmark is to keep employer stock to no more than 5–15% of your net worth. Concentration beyond that exposes your financial life to unnecessary risk. Shares above your chosen threshold should be systematically redirected into a diversified portfolio that can better support long-term goals.

Mistake 10: Treating RSUs as ‘play money’

Fix: Ask: “If this were cash, would I buy company stock with it today?” If not, sell and reallocate.

Mistake 11: Selling or holding based on emotion

Fix: Automate the decision by setting a repeatable rule rather than relying on gut feelings. This approach minimizes regret, fulfills emotional needs by removing “what if” second-guessing, and strengthens financial outcomes by ensuring consistent diversification over time.

Mistake 12: Building Lifestyle on Uncertain Income

Fix: It’s dangerous to anchor your everyday lifestyle to RSUs as though they’re guaranteed. Stock prices fluctuate, grants can shrink, and careers shift. RSUs and bonuses should be part of your overall income picture — but your core living expenses should remain sustainable without them. By leaving margin for volatility, you can treat RSUs as accelerators of progress rather than foundations of your budget.

Mistake 13: Not linking RSUs to your financial plan

Fix: Direct RSU proceeds toward specific goals: emergency fund, down payment, debt payoff, or retirement accounts. Consider mapping proceeds into buckets:

- Now: Short-term needs and cash safety net

- Soon: Big expenses like education or a home

- Later: Retirement and financial freedom

A Checklist for Smarter RSU Management

Instead of letting RSUs “just happen” in the background, approach them as part of your financial system:

- Know your Vesting Schedule: Put dates on the calendar and treat as scheduled cash-flow events.

- Confirm your Tax Plan: Understand your true tax liability, including both federal and state. Run projections to know what you actually owe, not just what your employer withholds.

- Decide How Much to Sell vs. Hold: An example of a goals-based framework could look like:

- 0–3 years → Sell and earmark for near-term goals

- 3–7 years → Diversify into broader markets

- 7+ years → Consider holding a portion if you want concentrated upside

- Reinvest Strategically: Instead of letting RSU proceeds sit idle, direct funds into your financial buckets: Now (cash reserves for safety), Soon (income assets for near-term goals), and Later (diversified growth assets for long-term wealth building).

- Avoid Double Taxation: Always check your 1099-B. If it shows $0 as your cost basis, request the supplemental version from your brokerage. Remember, you already paid taxes as wage income when you acquired the stock position. Otherwise, you risk paying tax twice.

- Stay Proactive: Routinely revisit the plan with your advisor to adjust for changes in grants, income, and lifestyle objectives.

For a valuable checklist to better understand your RSU holdings, check out:

From Company Stock to Life Goals

Employees with RSU based income often juggle complex pay packages, volatile equity, high cost of living, and evolving lifestyle needs. Handled intentionally, RSUs can help create lasting financial security by:

- Funding an emergency reserve before starting a family

- Turning equity-based compensation into a down payment on a first home

- Maintaining more reasonable company stock exposure to enhance peace of mind, financial flexibility, and greater investment portfolio resiliency

Decide what priorities you want to accelerate: financial independence, education, vacation home, kids’ weddings, or something else. Quantify them, and use your RSUs intentionally.

RSUs aren’t just a nice work perk. They’re part of your total compensation and should be used to help you reach and accomplish your goals.

The Affinity Approach to RSU Planning

At Affinity, we integrate RSU planning into your overall financial strategy:

By combining tax awareness, risk management, and goal alignment, your RSUs aren’t just company stock. They transform into a powerful part of your financial foundation, a bridge to financial freedom.

Your Next Vesting, Your Next Step

The next time your RSUs vest, pause and ask yourself:

- Would I buy more of this stock today if I were handed the cash instead?

- Am I comfortable with how much of my net worth is tied to my employer?

- Do I know what my actual tax bill will be, not just what was withheld?

If you’re unsure, you’re not alone. These are common challenges, and the good news is they can all be solved with a thoughtful, proactive plan.

When approached with clarity, RSUs shift from being a source of stress into a stepping stone toward financial freedom. Each vesting becomes more than just another payday. It becomes an opportunity to take the next step toward the future you want.

Disclaimer: This article is for general informational purposes only and is not intended to provide, and should not be relied on for, legal, tax, or accounting advice. Please consult a qualified estate planning attorney or tax advisor regarding your individual circumstances.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation