How Retirees Turn Tax Planning into Long-Term Financial Confidence

Three-Part Series Overview

Part 1: Foundational tax-planning principles (Tax-Savvy Wealth Guide Principles 1–3)

Part 2: Income, equity, and complexity for ambitious professionals (Tax-Savvy Wealth Guide Principles 4–6)

Part 3: Retirement, legacy, and multigenerational planning (Tax-Savvy Wealth Guide Principles 7–9)

At a Glance: The Principles Covered in This Article

If you only read one section, start here.

- Retirement creates powerful tax-planning windows.

The years before Social Security and Required Minimum Distributions offer opportunities to reshape lifetime tax outcomes. - Lower-income years can be used strategically.

Roth conversions, capital gain harvesting, and income timing matter most before higher brackets and Medicare surcharges apply. - Withdrawal sequencing directly affects longevity and taxes.

Which accounts you draw from, and when, influences both portfolio lifespan and total taxes paid. - Medicare costs are tied to tax decisions.

Poor coordination can trigger IRMAA surcharges even when spending stays steady. - Giving and legacy decisions carry tax consequences.

Charitable strategies, gifting, and estate planning can reduce taxes while supporting family and causes. - Tax law changes increase the need for coordination.

Recent legislation reshaped brackets, phaseouts, and income thresholds, making multi-year planning more impactful.

At Affinity Financial, this stage of planning is approached with careful attention to timing, sequencing, and tax coordination, so retirement decisions are made with clarity, not urgency.

This article is the final installment in a three-part series based on Affinity Financial’s Tax-Savvy Wealth Guide. After covering Tax Prep vs. Tax Planning: Three Principles to Help You Keep More of What You Earn and Tax Planning for High-Earners: Three Strategies to Strengthen Your Financial Flexibility, the focus now turns to strategies unique to retirement years, where well-timed tax decisions can meaningfully shape the rest of your financial life.

Keeping more of your retirement income begins with understanding how taxes evolve once the paychecks stop. This final installment of Affinity Financial’s Tax-Savvy Wealth Guide series focuses on the strategies unique to retirement years, when well-timed tax decisions can meaningfully shape the rest of your financial life.

Strategic Tax Choices in Retirement Help Preserve What You’ve Built

Retirement changes your income, withdrawal patterns, Medicare costs, and tax outlook. It also opens several powerful planning windows. The years before Required Minimum Distributions (RMDs), your Social Security strategy, and how you choose to give all influence how long your money lasts and how much ultimately stays with you instead of the IRS.

The three principles below are designed for retirees who want to build flexibility, reduce lifetime taxes, and create meaningful impact for the people and causes they care about most. They also highlight where working with a planner who brings real tax experience to the table makes a measurable difference—because timing, coordination, and sequencing matter more than ever.

From Retirement to Generational Impact

How strategic tax planning reduces lifetime taxes and expands what’s possible

👉 7. Retirement Can Open the Door to Strategic Tax Control

The years before RMDs and Social Security aren’t quiet—they’re golden.

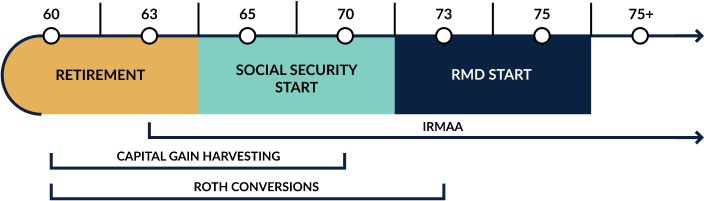

Retirement often brings a drop in earned income, which, if you’re planning proactively, opens new opportunities. The years between retirement and the start of Social Security, pension, and Required Minimum Distributions (RMDs) can be golden windows to reshape your tax future.

Think of this period as tax-rate arbitrage. Use low-income years as a tax repositioning opportunity to avoid higher tax brackets and Medicare surcharges later in retirement. Remember, this stage isn’t about doing more; it’s about being deliberate. A few thoughtful choices now can create lasting efficiency and peace of mind later.

📌 Strategic Moves:

How strategic tax planning reduces lifetime taxes and expands what’s possible:

- Convert pre-tax dollars to Roth while in low brackets

- Realize long-term capital gains and qualified dividends at the 0% tax rate

- Delay Social Security and pension income to optimize taxable income timing

- Mindfully avoid higher future Medicare IRMAA brackets

These opportunities exist whether you’ve already retired or are planning to transition soon. A tax-experienced advisor can help you identify the window, quantify your bracket room, and avoid unintended chain reactions across Medicare, income taxes, and future withdrawals.

Tax Window Timeline (ages 60 to 75)

👉 8. The “Where and When” of Withdrawals Matters More Than You Think

Which account you tap, and when, can make or break your plan.

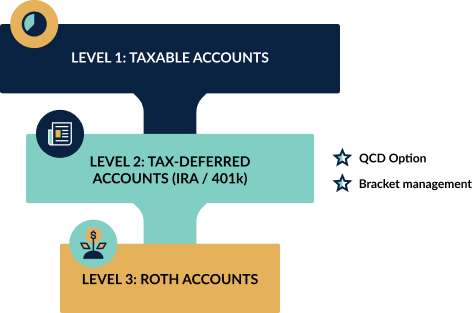

The order and sequence of retirement withdrawals from different accounts dramatically shape how long your savings last and how much ultimately goes to the IRS instead of you.

Many retirees simply default to drawing from one account at a time or guessing their way through the process. But a well-crafted withdrawal strategy can meaningfully enhance the growth and preservation of your retirement nest egg.

🎯 Tax-Savvy Planning:

- Blend taxable, tax-deferred, and Roth withdrawals to control tax brackets and deduction opportunities

- Consider Qualified Charitable Deductions (QCDs) for required distributions if at least age 70 ½ and charitably inclined

- Aim to “fill” lower tax brackets without triggering Medicare surtaxes

Withdrawal coordination is one of the clearest places where real-world tax experience pays off. A well-timed Roth withdrawal or a shift in sequence can significantly impact your assets without altering your lifestyle.

Withdrawal Waterfall

👉 9. Act with Multigenerational Wealth and Legacy Planning in Mind

Legacy is about more than what you leave; it’s how you live and give along the way.

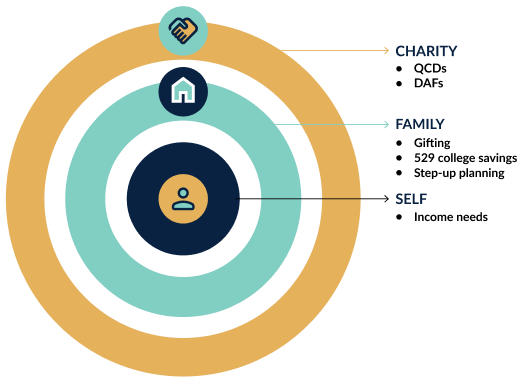

Your golden years are a powerful time for meaningful generosity. However, not every act of giving is automatically tax-smart by default. Intentionally integrating multigenerational and legacy goals into your tax plan can potentially offer a valuable opportunity to support family or causes and reduce your tax burden.

🎁 Ways to Give with Impact and Efficiency:

- Consider family gifting up to annual gift exclusion ($19,000/person in 2025) or fulfill larger gifts with lifetime gift exclusion and a timely filing of a Gift Tax Return

- Transfer appreciated shares to children in lower brackets

- Use Qualified Charitable Distributions (QCDs) or Donor Advised Funds (DAFs) for flexible giving

- Fund 529 college savings for grandchildren with multi-year lump sum options

- Consider step-up in basis when holding assets with unrealized gains

- Align your estate plan for efficient transfer of wealth and avoidance of estate tax

Thoughtful legacy planning often requires both tax literacy and personal clarity. Retirees who combine the two can create positive outcomes that ripple across generations.

💬 Case Snapshot:

A retired couple funded a $50K Donor-Advised Fund with appreciated stock, eliminating a $12K capital gain tax, while also fulfilling three years of charitable giving goals. In the same year, they gifted appreciated stock shares to a child in graduate school, realizing zero tax while supporting tuition.

By planning their giving intentionally, they met their philanthropic goals, minimized their tax burden, and set the stage for a smoother wealth transition to the next generation. The result wasn’t just tax savings—it was alignment between their generosity, their values, and their long-term plan.

legacy giving map

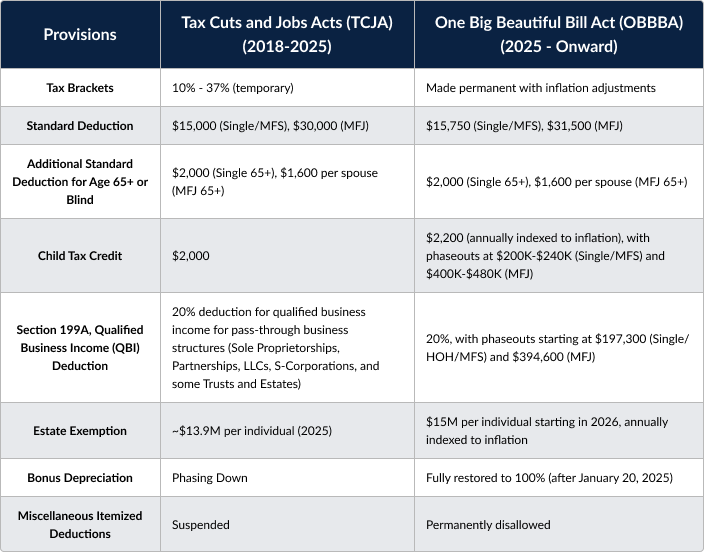

🎯 Bonus Tip: Why the One Big Beautiful Bill Act (OBBBA) Demands a Fresh Look

What You Don’t Know Could Cost You

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law, introducing sweeping changes to the tax code for individuals, families, business owners, and retirees.

Many of these provisions create new opportunities but also new pitfalls, especially because more deductions and credits are now tied to Modified Adjusted Gross Income (MAGI). Strategic coordination of income, deductions, and timing has never mattered more. Done well, this could unlock thousands in tax savings annually. Miss it, and you may pay more than necessary, year after year.

The new OBBBA tax legislation reshaped:

- Tax bracket income thresholds

- Phaseout ranges for tax deduction and credit eligibility

- Account contribution limits and distribution rules

- Tax incentives for highly compensated professionals, self-employed business owners, families, and retirees

Some benefits are permanent, but many expire between 2025 and 2029. Between now and 2028, when many of these temporary provisions are slated to sunset, tax planning is becoming more complex, but also more powerful. Smart, multi-year planning can lock in advantages before they disappear.

If your tax plan hasn’t been updated to reflect these changes, your wealth strategy may already be outdated.

Resource: https://affinity.financial/wp-content/uploads/2025/08/The-OBBBA-Comparison-Guide.pdf

Article: https://affinity.financial/the-2025-one-big-beautiful-bill-act/

Your Tax Perspective Shapes Your Retirement Future

Retirement creates more tax choices, and the right strategy can impact your life for decades. Whether you’re already retired or entering that final stretch toward it, understanding how income, withdrawals, giving, and timing interact can help you protect more of what you’ve built.

Affinity Financial’s Tax Awareness Self-Reflection Survey offers a simple way to get clarity. It draws on years of tax-focused planning experience to help you evaluate how well your current approach supports both your retirement income and your long-term goals. The assessment highlights strengths, uncovers blind spots, and gives you a clearer sense of whether your strategy is prepared for the transitions ahead.

Take the survey and see how aligned your retirement decisions are with tax-smart planning.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation