Affinity Insider | August 2025

Ambitious, hard-working people (you, me, and so many others) tend to stay focused on what’s next. The next goal. The next milestone. The next challenge to solve.

This July marked five years since I launched Affinity Financial. And while much has changed—markets have shifted, tax laws have evolved, life has moved through new stages (and yes, the gray hairs have multiplied)—the heart of this work remains unchanged: helping align your financial life with what matters most, and walking alongside you with clarity, care, and conviction.

This edition of The Affinity Insider acknowledges a meaningful milestone and reaffirms continued enthusiasm for the road ahead.

Here’s what you’ll find inside:

📌 Your Finances in Focus — Five high-impact financial planning lessons that hold up across every season of life.

📈 Market & Investing Commentary — Five forces shaping the markets, and what they mean for long-term investors.

🎯 Featured Article — A practical guide to the One Big Beautiful Bill Act (OBBBA), and why tax strategy matters more than ever.

📚 What I’m Reading, Watching & Listening To — Five articles worth paying attention to, on housing, global trade, the shape of 2025, and more.

🌊 Behind the Scenes — Five years of Affinity, and the values that continue to guide our path.

Whether you’ve been with us from the beginning or connected more recently, thank you. These years and the impact they’ve created is deeply tied to the people we’ve had the privilege to serve.

Let’s begin.

💸Your Finances in Focus

Five High-Impact Financial Planning Lessons

As life evolves, so does the way we think about money. Over the years, I’ve walked alongside clients through career changes, market volatility, expanding families, and life’s inevitable surprises. Here are five timeless lessons that have emerged as the foundation of resilient, purpose-driven planning:

1. Every Dollar Has a Job

Investing is powerful, but not every dollar belongs in the market. Some dollars should be liquid to support peace of mind, flexibility, or upcoming life transitions. Clear purpose reduces second-guessing and builds confidence.

2. Life Transitions Deserve Planning, Not Reaction

Big decisions—retirement, a home sale, business exit, career pivot—aren’t just financial. They touch identity, timing, and relationships. The best outcomes happen when planning precedes action, not the other way around.

3. Your Financial Foundation Is a Launchpad, Not a Finish Line

Building wealth isn’t the end goal, it’s the beginning of new possibilities. A solid foundation gives you the freedom to invest in your health, your family, your impact, and the next chapter of your life.

4. Disciplined Investors Are Rewarded

The last five years brought plenty of noise: COVID, inflation, rising interest rates, election cycles, and now sweeping tax reform. Still, those who stayed committed to a clear investment strategy have been rewarded, not because they predicted the future, but because they stayed the course.

5. Compounding Works, In Money and in Life

Financial returns compound over time, but so do good decisions. Steady habits, thoughtful reflection, and aligned action create a powerful flywheel effect. Planning isn’t about one perfect move, it’s about consistency and clarity over time.

📈Market & Investing Commentary

Five Forces Shaping the Market Right Now

1. Earnings Season Reassures Investors

Q2 earnings surprised to the upside across sectors:

- S&P 500 earnings grew 10.7% YoY, far better than feared

- Margin strength was notable, even among companies heavily exposed to tariffs

- Tech, Communication, and Financials led the way, while Health Care struggled

Companies are not sounding the alarm about the economy, and recession fears have eased. Still, the full effect of tariffs is yet to materialize and many companies report that economic uncertainty is weighing on customer behavior and delaying decision-making.

2. Fed Holds Steady, Market Eyes Future Cuts

The Federal Reserve left rates unchanged at 4.25%–4.50% in July. Chair Powell struck a cautious tone, saying that while inflation is moderating, the Fed is not yet ready to cut unless incoming labor and inflation data show more deterioration.

Interestingly, rate cut expectations spiked back up after a weak jobs report, with markets now pricing in an over 80% chance of a September cut. This sharp swing highlights the Fed’s data-dependency and the market’s sensitivity to any sign of softening.

3. Labor Market Cooling, Not Cracking

July’s jobs report showed 73,000 new jobs, well below expectations. In addition, previous months were revised downward, a common occurrence that reflects ongoing adjustments in the data. The unemployment rate ticked up modestly to 4.2%, still comfortably below historical averages.

While recent reports suggest the labor market is losing some momentum, there are no signs of broad-based weakness. Many employers continue to note stable demand for workers, and wage growth, while moderating, remains solid. As always, labor metrics can be choppy month to month and are best viewed in context.

4. Washington Hosts AI Summit, Signals Strategic Priority

The “Winning the AI Race” summit brought together tech leaders and policymakers to emphasize U.S. leadership in artificial intelligence. The administration announced an AI Action Plan, with new executive orders focused on chip supply, job creation.

At the same time, capital spending on AI infrastructure—from data centers to semiconductor equipment—has become a major economic driver. Economists estimate this AI boom added over 1.3 percentage points to Q2 GDP, outpacing consumer spending as a contributor to growth.

5. OBBBA Signed Into Law, Reshaping Tax Planning

The One Big Beautiful Bill Act was officially signed into law, overhauling tax brackets, deductions, and phaseouts. For investors, this makes tax efficiency more important than ever. Strategies like Roth conversions, asset location, and timing of income now require careful coordination to avoid losing access to valuable new tax benefits.

As always, we’re here to help you cut through the noise and stay aligned with your goals—calmly, clearly, and with conviction.

🎁Featured Article

2025’s Big Tax Shake-Up: Your Practical Guide to the One Big Beautiful Bill Act (OBBBA)

The One Big Beautiful Bill Act (OBBBA) is reshaping how families, retirees, and business owners approach tax planning. It offers bigger deductions for some, hidden pitfalls for others, and important deadlines that could impact your bottom line. Now is the time to understand the rules — and create a proactive, personalized tax strategy that keeps more money working for you.

In this month’s feature article, you’ll learn about:

- How the higher SALT cap works and the income ranges where it phases out

- The new charitable deduction floor and how to avoid losing write-offs

- Expanded benefits for professionals, families, retirees, and business owners

- Limited-time tax credits for clean energy, EVs, and home upgrades

- Case studies and planning tips to limit your tax exposure

Some OBBBA benefits will disappear by 2029, and a few as soon as 2025. Others shrink or vanish once your income crosses certain thresholds. Knowing these timelines and limits now gives you the opportunity to act, and in some cases, make year-end moves, to preserve benefits and lower your tax bill.

👉 Read: “2025’s Big Tax Shake-Up: Your Practical Guide to the One Big Beautiful Bill Act (OBBBA)”

Did You Know? 👇

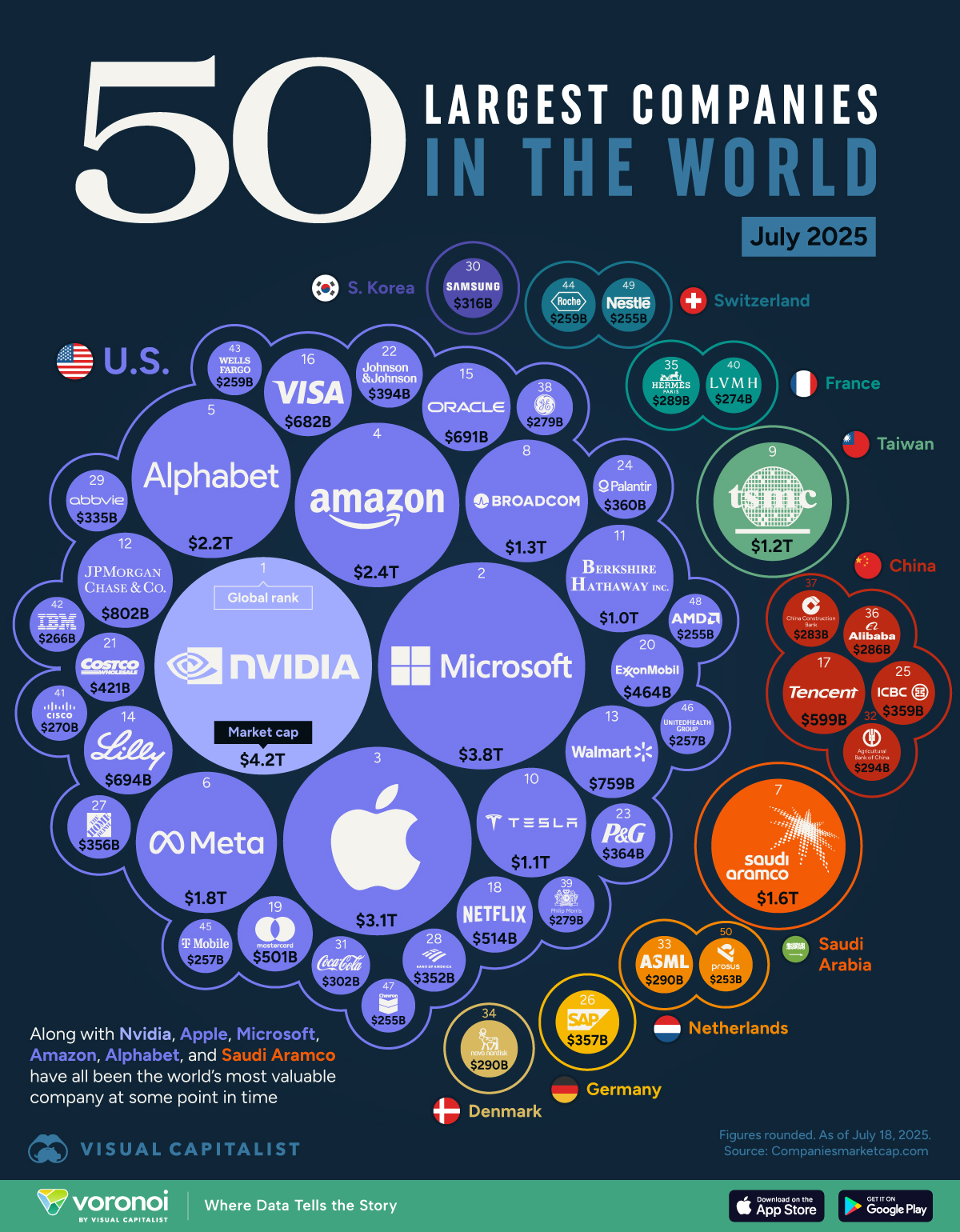

U.S. firms make up 34 of the 50 most valuable companies in the world. Big Tech sits comfortably in the top six slots, while stalwarts like Berkshire Hathaway and Walmart anchor the trillion- and near-trillion-dollar tiers. Financial heavyweights JPMorgan Chase and Visa round out America’s footprint, showing that the country’s economic breadth—spanning chips, cloud, e-commerce, and consumer staples—remains unrivaled.

Asia contributes eight names to the most valuable companies in the world, led by Taiwan’s TSMC at $1.2 trillion and China’s Tencent at just under $600 billion.

Europe fields eight companies as well, with luxury houses Hermès and LVMH representing consumer demand, while Novo Nordisk and Roche highlight biotech strength.

📰🎧🍿What I’m Reading, Listening To, and Watching

🏡 Has the Housing Market Collapse Arrived? (First Trust)

📆 What Will 2025 Be Remembered For? (Evergreen Gavekal)

📊 50 Facts From 1H 2025 (The Idea Farm)

🤝 The Biggest Deal Ever Made: Who wins the U.S.-EU trade deal? (Jacob Shapiro)

📈 False Choices, Real Costs: Structural Flaws in the Growth–Value Duality (Research Affiliates)

🏡Behind the Scenes

Five Years In: A Milestone Built on Partnership & Meaning

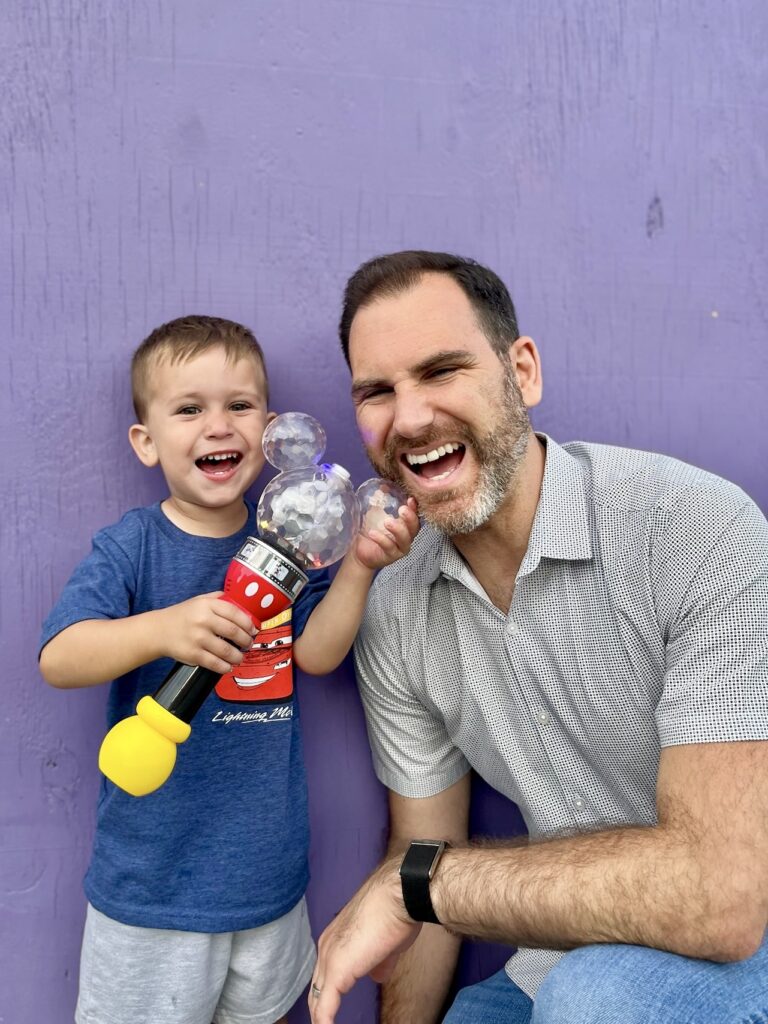

This July marked five years since the launch of Affinity Financial. In many ways, it still feels like Day One because the underlying vision hasn’t changed (though I’ve gained a bit more perspective, experience, and yes, a few gray hairs along the way.)

On July 17, 2020, I shared an open-letter press release announcing Affinity’s beginning. In it, I wrote:

“This is Day 1 for Affinity Financial. … The greatest value I bring to my clients is to align their means with their meaning. I have founded Affinity Financial specifically to help our clients live more fulfilling lives.”

Read the original press release

Affinity has never been about chasing a growth target or a specific endpoint. The aim is to continuously show up with clarity and conviction, for my clients, for myself, and for the people I care about most. I wanted to build a firm rooted in core values:

- Relationships over transactions

- Thoughtfulness over haste

- Long-term alignment over short-term hype

Over the past five years, Affinity has grown. But more than growth, we’ve deepened—our client relationships, our planning philosophy, our understanding of what really matters.

I’m incredibly grateful to those of you who’ve been a part of this journey—from the early supporters to those who’ve come alongside more recently. Your stories, your trust, and your openness have shaped this firm into something I’m incredibly honored to lead.

Thank you for the gift of meaningful work, valued relationships, and the opportunity to help build better futures.

P.S. ~ If there’s ever been a moment where you felt supported, understood, or simply more at ease through our work—I’d love to know. Just reply whenever the thought strikes.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation