Affinity Insider | February 2025

The recent fires in Los Angeles have been a stark reminder of how quickly life can change. Homes evacuated in the middle of the night. Memories and belongings hastily packed into suitcases. The uncertainty of what will remain when the smoke clears.

Disasters don’t send invitations. They don’t check your schedule or ask if you’re ready. They just arrive—unexpected, uninvited, and often, unfair.

Some of you, my clients and friends, have experienced this firsthand. You’ve faced the fear, the waiting, the what-ifs. And even if the flames didn’t touch your house, the experience leaves a mark.

I don’t have words to erase the hardship, but I do want to say this: I’m here. Not just as a financial planner, but as a steady presence in life’s uncertainties—a trusted partner to listen, to guide, and to help make sense of what comes next.

Financial planning isn’t only about numbers. It’s about building a foundation strong enough to withstand whatever comes next. If you’re feeling the weight of uncertainty, let’s talk—about your plan, your future, and what truly matters.

Because resilience isn’t just something we admire. It’s something we strengthen, one step at a time.

💸Your Finances in Focus

The 2024 Tax Filing Season is Here

Tax season is officially underway, and we’re here to help you navigate it efficiently while maximizing your hard-earned dollars. Here’s how we can work together to streamline your tax preparation for 2024:

1. Access Your 2024 Tax Organizer

If your tax preparer has provided a tax organizer, we have uploaded it to your Financial Planning Portal. You can find it within the Vault folder labeled “Tax 2024.”

If you need help accessing the folder or would prefer to receive the document via email or USPS, just let us know.

2. Gather & Upload Your Tax Documents

As you receive your tax forms, be sure to compile and securely upload them to the “Tax 2024” folder or use this Secure Upload Link.

📌Note: Affinity Financial automatically receives tax documents for your Charles Schwab and Fidelity managed accounts. These tax forms are expected to be available by mid-February.

3. Schedule a “Let’s Get Organized” Meeting

Have questions? Need guidance? Want to ensure that there are no missing pieces to the tax puzzle? We’re happy to review your tax documents together to ensure completeness.

Our goal is to make this your smoothest tax filing experience yet—no question is too big or small.

📅Schedule Your “Let’s Get Organized” Meeting

4. Book Your 2024 Tax Prep & Planning Meeting

Once your tax details are compiled and ready for submission—or if you have a draft return that needs review—this meeting will help ensure:

✅ Your income is accurately reported

✅ Deductions and credits are fully optimized for your unique situation

✅ Opportunities to minimize taxes now and in the future are explored

✅ You gain a clearer understanding of your total tax position

📅Schedule Your “2024 Tax Prep & Planning Meeting”

Smart tax planning is key to long-term financial success. With the right strategy, tax season becomes an opportunity—not a burden. As your tax advocate, we focus on ensuring every detail is covered so you can improve outcomes.

We are committed to making this process straightforward and stress-free. Let us know if you have any questions.

📈Market & Investing Commentary

Markets kicked off the year on a strong note. U.S. stocks gained 3.1%, reflecting broad strength in U.S. equities. International stocks climbed 4.5%, supported by easing economic concerns in Europe and Asia. U.S. bonds saw modest declines of 0.7% as shifting interest rate expectations created some headwinds.

A Market Highlight: Innovation & Market Leadership

Even in a strong market, individual stocks can experience turbulence. Nvidia and other high-growth tech names saw volatility, driven by competitive pressures in AI and shifting investor sentiment around valuation. While Nvidia declined early in the month, its movement is a reminder that even market leaders face challenges—and that innovation never stands still. At the same time, advancements in AI and declining costs could accelerate adoption across industries, enhancing efficiency, boosting corporate profitability, and expanding long-term market potential.

Key Lessons from January’s Market Trends

📌 Strategic Allocation Over Stock Picking

Broad market strength highlights the value of a well-balanced portfolio rather than reliance on any single stock or sector. Leadership shifts over time, and a diversified approach helps capture long-term opportunities.

📌 Innovation is Disruptive

Industries evolve, and technological advancements bring new players into the fold. Exposure to global trends—rather than a concentrated bet—allows investors to participate in innovation while managing risk.

📌 Discipline Unlocks Long-Term Success

Short-term market swings can be unpredictable, but a structured and disciplined strategy helps investors stay focused on long-term financial goals.

The Bottom Line

With markets broadly positive in January, this month was a reminder that sticking to a strategic, diversified, and disciplined approach is key to investment success. Rather than reacting to short-term movements, we remain focused on building resilient portfolios designed to stand the test of time.

🎁Featured Article

The Guardrails Strategy: A Smarter Approach to Sustainable Retirement Income

Some retirees live in fear, pinching pennies and never enjoying the wealth they worked so hard to build. Others spend freely, hoping the math works out—until a market dip or unexpected expense sends them scrambling.

Both extremes lead to regret.

What if there were a better way? A strategy that keeps you on track, gives you permission to spend, and ensures your money lasts as long as you do?

That’s the power of the Guardrails Strategy—a smarter, more flexible approach to creating a Retirement Paycheck that empowers you to spend with purpose and confidence.

Did You Know? 👇

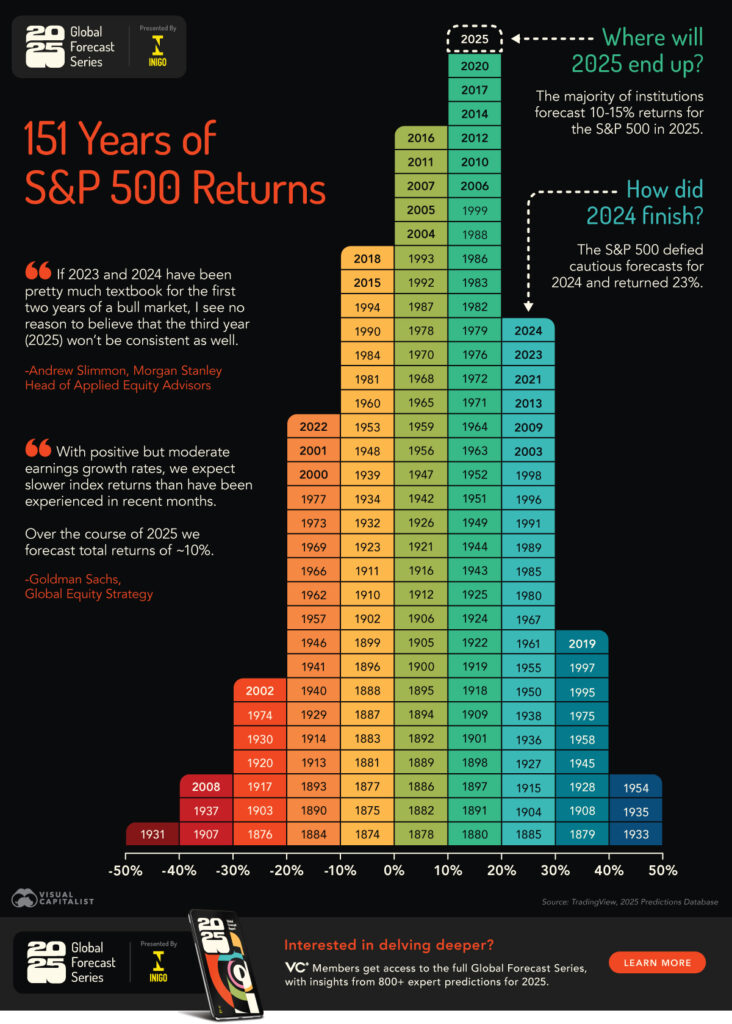

Stocks have delivered an average annual return of 10.42% since 1926. Staying invested in stocks during turbulent times requires patience, but historically, it has proven to be a rewarding strategy.

📰🎧🍿What I’m Reading, Listening To, and Watching

WEALTH

🤔 How To Prepare For Tariff Day (The Macro Compass)

📊 Maybe the Only Chart You Need to Understand 2025 (Josh Brown)

🤑 Audiobook – Shareholder Yield: A Better Approach to Dividend Investing (The Meb Faber Show)

📈 Updating My Favorite Performance Chart For 2024 (A Wealth of Common Sense)

🫧 On Bubble Watch (Howard Marks)

WELL-BEING

🚸 Money Habits for Kids & The Power of Writing (Vitaliy Katsenelson)

💯 Don’t Hide Behind Authenticity: Embracing True Authenticity (Meaningful Money)

⚭ Make Saving Automatic in Your Marriage: 5 Graphics to Help (Modern Husbands)

🏆 Chris Sacca — How to Succeed by Living on Your Own Terms (Tim Ferriss Show)

🍫 Mars Inc, The Chocolate Story (The Acquired Podcast)

🏡Behind the Scenes

Lately, our little one has been completely enchanted by dragons. Every night, we dive into a dragon story, and without fail, he asks: “Are they nice dragons or mean dragons?” Most of the time, they’re nice—and often, magical. It’s the perfect age for him to be exploring a world where good can triumph over mythical challenges, where dragons bring both wonder and warmth.

It’s fitting that this love of dragons blooms just as we welcome the Lunar New Year, this time celebrating the Year of the Snake. In the Chinese zodiac, the snake symbolizes wisdom, intuition, and transformation. It’s a year for shedding old skin, reflecting on the past, and stepping boldly into the future.

My wife and I invited a few close friends to share in our Lunar New Year traditions, a small but meaningful gathering. The highlight, of course, was the culinary feast of favorites: fried wontons and cashew chicken. These annual rituals are more than just food; they’re about honoring our roots and creating space to gather, to reflect, and to be present with those we care about.

May the year bring you growth, reflection, and abundant good fortune as you continue to embrace your own journey.

P.S. ~ What new beginnings or reflections might this year hold for you?

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation