Affinity Insider | March 2025

Partnership isn’t just about sharing the weight—it’s about amplifying the joy.

When we walk through life’s celebrated moments together, we find that the joy doesn’t just double; it expands beyond what we can measure.

From a couple’s first home to the thrill of a new career opportunity, the laughter shared during a baby shower, or the collective energy of wedding planning, these moments become more vibrant when experienced as a team.

It’s not just the milestones that matter, but the shared intention of moving forward together. Because when we connect, we co-create the story—and that story becomes richer, more meaningful, and more enduring. It’s truly a privilege to be a partner in your journey.

💸Your Finances in Focus

Year-Round Tax Strategies for Building Wealth

As we navigate through tax season, it’s essential to remember that tax management isn’t justabout properly reporting the prior year’s earnings. Filing a tax return is table stakes. True tax planning is about laying the tax efficient foundation for your long-term financial future.

While annual tax preparation focuses on reporting income, expenses, and deductions from the past year, year-round tax planning is about proactively making strategic decisions that minimize your tax burden and maximize your wealth over time. Tax preparation is a necessary task—tax planning is the strategy that helps you build wealth.

Tax preparation is retrospective. It’s about compliance, ensuring that everything is reported correctly to Federal and local governments. But once the year ends, opportunities to reduce taxes on that year’s return are limited. Tax planning, on the other hand, is prospective. It’s about anticipating changes, taking advantage of tax-saving opportunities, and adjusting your financial strategy to optimize for the future.

When you plan ahead, thinking in years and decades, even small improvements in an investor’s after-tax growth rate can make enormous differences in the amount of wealth accumulated overtime—and that can mean the difference between achieving a financial goal ahead of schedule or failing to hit the mark.

Tax planning is an ongoing endeavor that is specific to your unique life and financial circumstances. Here are just a few tax-smart strategies we use to help you build wealth, organized by income sources and investment sources:

Income Source Strategies

- Wage-Earning Employees: Maximize tax-deferred retirement contributions, utilize tax-advantaged accounts like HSAs or FSAs, and take full advantage of employer benefits like matching contributions and other fringe benefits to reduce your taxable income.

- Executive Compensation: Optimize stock options, deferred compensation plans, and non-qualified retirement plans to manage the tax treatment of your income and strategically time the exercise or sale of your equity compensation.

- Retirees: Focus on tax-efficient withdrawals from retirement accounts, consider Roth conversions to lock in tax-free growth, and manage Social Security benefits to avoid unnecessary taxes on your retirement income.

- Self-Employed Business Owners: Take advantage of tax-deferred retirement plans like Solo 401(k)s, capture above-the-line deductions, track all deductible business expenses, and explore opportunities like Qualified Business Income (QBI) deductions through strategic structuring of business type and awareness of profitability.

Investment Source Strategies

- Tax-Efficient Growth Investing: Focus on minimizing tax exposure while maximizing returns. This includes choosing investments that generate fewer taxable events, such as holding long-term assets or utilizing tax-efficient funds designed to reduce taxable distributions.

- Direct Indexing & Tax Loss Harvesting: Direct indexing allows you to customize your portfolio to mirror an index while providing flexibility to optimize tax outcomes. By strategically selling losing positions, you can offset gains elsewhere in your portfolio, reducing your overall taxable income. Tax loss harvesting is an excellent way to lower your tax bill while maintaining your investment strategy.

- Tax-Smart Income Strategies: Tax-smart bonds—such as US Treasuries or municipal bonds—can be a great way to reduce taxes while earning interest. Interest income from these bonds is typically exempt from federal or state income taxes, offering tax-free income for the right investor.

- Charitable Giving & Family Gifting Strategies: Charitable giving can be a powerful tax-saving tool, especially when you donate appreciated assets to avoid capital gains taxes while securing a charitable deduction. Family gifting strategies also help minimize estate taxes, allowing you to transfer wealth to heirs or loved ones in a tax-efficient manner.

True wealth-building happens when we implement tax strategies that work throughout the entire year—not just at tax time. By integrating these strategies into your financial plan, we aim to make the most of your money while minimizing taxes at every step.

📈Market & Investing Commentary

In February 2025, U.S. equity markets experienced notable declines, influenced by policy uncertainties and economic data. The S&P 500 fell by 1.3%, the Dow Jones Industrial Average decreased by 1.4%, and the Nasdaq Composite tumbled by 3.9%.

International equities, however, showed resilience. Developed markets outside the U.S., asrepresented by the MSCI World ex USA Index, gained 1.8%, while emerging markets added0.5%. This performance was bolstered by positive developments in regions like China, where equities rose 11.7%, driven by expectations surrounding technological advancements and regulatory improvements.

In the fixed income sector, bonds delivered positive returns. The U.S. Aggregate Bond Index returned 2.2% in February, bringing its year-to-date gain to 2.7%. This uptick was supported by falling U.S. Treasury yields, as investors sought safer assets amid equity market volatility.

Overall, the outperformance of value vs. growth, international vs. domestic, and bonds vs. stockstranslates into favorable outcomes for globally diversified, balanced portfolios.

Primary Drivers of the US Stock Pullback

Looking at the primary divers of the pullback, we identify three factors:

- Economic Slowdown: First off, we are coming off a very strong year, with GDP growth of2.8% in 2024. But over the past month we have been getting a slew of economic data coming in below expectations: retail sales, purchasing manager index (PMI) and initial jobless claims to name a few. Additionally, a key recession indicator has once again been activated as the spread between the 10-year and three-month Treasury yields turned negative.

All of this said, it simply indicates a drop in momentum as we come down from high growth to more normal levels.

- Trade Uncertainty: President Trump has implemented a series of tariffs with key trading partners including Canada, Mexico and China, as well as proposals for new tariffs on Europe. This could very well spark a tariff war as those countries raise retaliatory tariffs onthe U.S. However, the problem is that the tariff noise may be weighing on corporate confidence. For example, businesses may hold off on capital investments and overall spending until the dust settles, which may result in ripple effects throughout the economy and markets.

While there may be some price increases and temporary slowdowns, tariffs themselves could have a less significant long-term impact on the overall economy, given other offsetting pro-growth policy measures.

- Consumer Confidence: Consumer and investor confidence is falling to period lows in the face of inflation worries, policy uncertainty, market volatility and weakness in key growth stocks. Essentially, investors have been waiting for the risk-off environment that would cause the seemingly invincible Magnificent 7 stocks to falter. Given these stocks tend to trade at very high valuations, if a correction were to happen, these stocks may be the hardest hit. And given they represent a key component on major indexes (like the S&P500), it could have broader implications for the markets.

At the end of the day, severe market corrections often happen in periods of euphoria where confidence is at extreme highs; given we have a “wall of worry” in place, any correction may be less pronounced.

The Bottom Line

There are several factors which are still supportive of a strong economy and markets, including: strong corporate earnings, broader artificial intelligence (AI) adoption, inflation remaining in a downward trend and labor market strength. Until we see more significant deterioration of economic growth, other than simply moderating from a strong starting point, there does not appear to be a high risk of a strong recession or a severe market drop.

🎁Featured Article

The Role of Cash Savings: A Buffer for Long-Term Resilience

Cash is foundational in money management—not just for survival, but for fueling growth.

Cash is a buffer, shock absorber, and safety net between where we are and where we want to go. Long-term wealth comes to those who manage the short-term well enough to stay in the game for big rewards.

The right amount of cash turns a financial crisis into an inconvenience. Holding the wrong amount? That’s when real damage happens.

Too much, and you’re missing out on growth. Too little, and you risk unnecessary stress when life throws you a curveball.

In this month’s article, we walk you through a simple, actionable framework for determining the appropriate amount of cash to hold, where to keep it, and how to maintain balance between stability and opportunity.

👉 Read “The Role of Cash Savings: A Buffer for Long-Term Resilience”

Did You Know? 👇

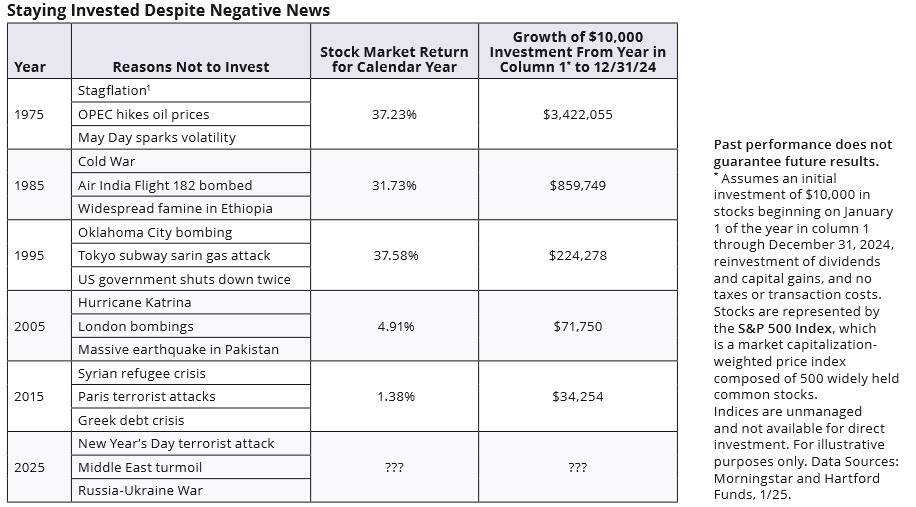

Staying invested in stocks despite negative news has historically been quite profitable.

Whether the headline comes from a newspaper or a push notification, there will always be negative news that will make investors wary. The table below shows standout events over the past half century. Disciplined investors who tuned out the noise and stayed invested in stocks were rewarded in the long run.

📰🎧🍿What I’m Reading, Listening To, and Watching

WEALTH

🕰️ Diversification is About Decades (A Wealth of Common Sense)

🤔 U.S. Growth Slowing Due To Policy Uncertainty (42 Macro)

🔋 Great Powers, Geopolitics, and the Future of Trade (Boston Consulting Group)

🪖 Trump Tariffs: Tracking the Economic Impact of the Trump Trade War (Tax Foundation)

🌎 Geopolitical Alpha: An Investment Framework for Predicting the Future (Marko Papic)

WELL-BEING

🗓️ Your Life in Weeks (Wait But Why)

🏡Behind the Scenes

Lake Arrowhead sits roughly two hours away from where we call home in Orange County. A winding drive into the mountains, where tall pines stretch skyward and the lake shimmers between them. The air, crisp and clean, carries the kind of quiet that lets you breathe a little deeper. It’s a place built for slowing down, for stepping away from the noise.

In mid-February, our family spent the weekend in this mountain town with close friends—fellow entrepreneurs and parents, all navigating the beautiful chaos of raising little ones. Six adults, three kids under three, and one unspoken goal: be present. No deadlines, no distractions, just time. Time to cook together, to laugh late into the night, to marvel at how quickly our children are growing.

The highlight for the kids? Skyline Park at Santa’s Village, a wonderland where imagination runs wild. My son, wide-eyed with excitement, climbed into the driver’s seat of his own tiny car for the first time. At first, he hesitated—unsure, cautious. I guided him, helped him steer, reminded him to look ahead. By the third lap, he cruised past Santa’s Workshop, pausing to admire and name each toy on the shelves.

These are the moments that don’t just happen unless we make them happen.

It’s incredible how the days feel long, yet the years race by. Time isn’t measured by the clock—it’s measured by how quickly our children grow, change, learn, and become their own little people with preferences, personalities, and newfound independence. One day, they’re gripping the wheel with uncertainty; the next, they’re confidently steering on their own.

We all say family, friendships, and time well spent matter most. But does our calendar reflectthat? If we are not careful, the spaces in our lives don’t stay empty for long; they fill with obligations, distractions, and the endless pull of what feels urgent. If we don’t intentionally set-aside time for what truly matters, something else will take its place.

So we made it happen. And that made all the difference.

Wishing you meaningful connections, cherished memories, and the presence to enjoy them.

P.S. ~ What’s your favorite way to slow down and be present? Hit reply—I’d love to hear.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation