Affinity Insider | May 2025

We’ve all heard the saying, “April showers bring May flowers.” It feels especially fitting after a month marked by market volatility, uncertainty, headlines, and moments that may have tested your resolve. While we can’t know exactly what May—or the rest of the year—has in store, we do know this: there are seasons for rain and seasons for sunshine. Together, they create the conditions for growth.

Through it all, I want to recognize and congratulate you for staying disciplined, staying invested, and staying focused on the financial plan we built together. That discipline is what keeps you on path, regardless of the short-term weather in the markets.

This month’s newsletter is here to keep you grounded and growing, no matter the forecast. Here’s a quick look at what you’ll find inside:

🌱 Your Finances in Focus – A smarter way to hold cash with high-yield, FDIC-insured flexibility now available to clients.

📉 Market & Investing Commentary – Why the market bounced back in April and what we’re watching as the next chapter unfolds.

🎯 Featured Article: “Crafting Your Couple’s Money Philosophy” —a guide to building stronger financial alignment in your relationship.

👀 What I’m Reading, Watching & Listening To – A curated list of articles and ideas shaping how we think about money, policy, and purpose.

✈️ Behind the Scenes – Reflections from recent conferences on risk, resilience, and what it really means to show up.

💸Your Finances in Focus

A Smarter Way to Hold Cash—Now Available to Clients

We’re always looking for ways to help clients make the most of their money—not just in the markets, but across all aspects of their financial lives. That’s why we’re excited to introduce a new benefit now available through our firm: access to Flourish Cash.

Flourish Cash is a high-yield savings solution designed to make your idle cash more productive—without sacrificing safety, flexibility, or ease of access.

Key Benefits:

✅ Competitive interest rate (currently 4.00% APY as of May 2025)

✅ Up to $6 million in FDIC insurance for individual, trust, business, or non-profit accounts

✅ Up to $12 million for joint or trust accounts with multiple owners

✅ No fees, no minimums, and unlimited transfers

If you’ve read our recent article on Building a Resilient Cash Savings Buffer, you already know that cash plays a vital role in financial planning—not just as a safety net, but as a strategic asset. Flourish Cash builds on that philosophy offering a modern platform to optimize how and where you hold reserves.

👉 Download the PDF factsheet for more details

If you’d like to explore whether this solution is a good fit your personal or business needs, simply reply to this email or schedule time to connect.

📈Market & Investing Commentary

After a rocky start to April, the stock market has rebounded with strength and surprising speed. While short-term volatility is part of the investing journey, it’s worth understanding why markets rebounded—and what we’re paying closest attention to going forward.

🚀 5 Reasons the Market Bounced Back

- Strong Earnings Season: Over 80% of S&P 500 companies have reported better-than-expected results, showing real resilience underneath the headlines.

- Record Share Buybacks: Corporations announced $234 billion in buybacks in April, the second-highest monthly total since 1984. This signals boardroom confidence and strengthens per-share fundamentals.

- Hard Economic Data Holding Up: Despite noise in the headlines, core economic indicators—like job growth, consumer spending, and manufacturing activity—have continued to show resilience.

- Federal Reserve Independence: Despite political pressure, the Federal Reserve held rates steady and maintained a data-dependent posture. Preserving central bank credibility remains critical for long-term investor confidence.

- Healthy Private Sector Balance Sheets: Corporate and household finances remain strong. U.S. companies are holding a near-record $2.9 trillion in cash, reinforcing capacity for investment and the ability to weather uncertainty.

🔍 What We’re Watching Moving Forward

- Global Trade Policy: Markets want clarity. The direction of tariffs, especially with China and Canada, will play a key role in investor sentiment and global supply chain health.

- Continued Economic Resilience: We’re closely monitoring trends in GDP, inflation, and employment. Strength across these areas has been encouraging, but staying power matters.

- Consumer Sentiment vs. Consumer Behavior: Households are still spending, but sentiment surveys remain cautious. If actions and attitudes align, it could shape the next leg of this market cycle.

- U.S. Tax Policy, Deregulation, and Deficits: Tax, spending, and regulatory policies carry long-term implications for markets. We’re evaluating whether current deficit trends support growth or raise concerns about future interest rates and inflation.

- The Strength (and Stability) of the U.S. Dollar: The dollar has eased recently as markets reassess Fed policy and global risks. A stronger dollar can pressure exports and tighten global liquidity, while a weaker one may stoke inflation or reflect fiscal concerns.

As always, we’re here to help you cut through the noise and stay aligned with your goals—calmly, clearly, and with conviction.

🎁Featured Article

Crafting Your Couple’s Money Philosophy

Money touches every part of your life together—your goals, your routines, your stress points, and your dreams. But few couples take the time to create a shared philosophy for how they want to manage it.

This month’s article is about How Couples Can Build a Shared Money Philosophy. It is a practical and heartfelt guide to help you align your values, communicate with intention, and create financial systems that support, not strain, your relationship.

Your financial life is shared. Your philosophy should be too.

Whether you’ve been together for 2 years or 20, this is a great moment to reconnect around your goals, your rhythms, and the future you are building as a team.

👉 Read: “Crafting Your Couple’s Money Philosophy”

Did You Know? 👇

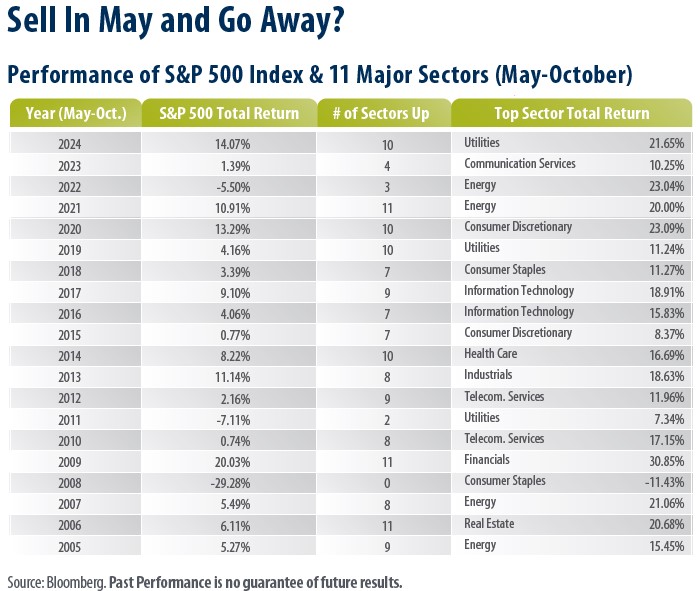

The data presented does not support the notion that investors should “sell in May and go away”.

From 2004 through 2024, there were just three instances (2008, 2011 & 2022) in which the S&P 500 Index posted a negative total return from May through October. Over this time period, an investor who remained fully invested in the US stock market from May through October enjoyed an average annual total return of 3.92% during those months alone, a significant figure when compounded.

We continue to advocate that investors consider their time horizons and take risk as appropriate.

📰🎧🍿What I’m Reading, Listening To, and Watching

WEALTH

🤷 The Uncertainty World (Mauldin Economics)

🧾 Analyzing Congressional Republicans’ Budget Proposal For The 2025 TCJA Extension (Kitces.com)

🤖 Trade, Tariffs, and Tech (Statechery)

🏢 The impact of uncertainty on investment, hiring, and consumer spending (Goldman Sachs)

WELL-BEING

⏱️ Four Thousand Weeks: Time Management for Mortals (Oliver Burkeman)

🏠 Selecting the Right Retirement Community (Journal of Financial Planning)

🏡Behind the Scenes

Over the past few weeks, I’ve found myself in some fascinating rooms filled with portfolio managers, economists, and practitioners, each trying to make sense of a world that isn’t standing still.

In one packed ballroom in Los Angeles, a panelist asked, “What risk aren’t investors pricing in right now?” In a quieter roundtable in Orange County, a fellow advisor shared how her clients are redefining legacy, not in dollars, but in values. Different conversations, same energy: people thinking deeply, sharing generously, showing up with intention.

I don’t go to these conferences for the lunch buffets or assorted tchotchkes. I go because I believe in lifelong learning and in surrounding myself with some of the most thoughtful minds in the business. I go because the people in these rooms—driven, generous, insightful—make me better. And a commitment to continually being better matters.

Being part of this profession means more than keeping up. It means leaning in, asking better questions, and staying connected—to new ideas, to trusted peers, and to a purpose bigger than myself.

The best ideas often don’t come with a slide deck. They come over coffee, in a quiet moment on the drive home, or in a follow-up call with a trusted colleague. They nudge you to think more clearly and they stick with you.

One speaker summed it up well: “Success won’t come from trying to out-trade the market minute by minute. It’ll come from staying grounded, staying disciplined, and making decisions based on evidence—not emotion.”

It resonated. Not because it’s flashy, but because it’s true.

In this profession, showing up and doing the work is essential. Not only to stay on top of market trends, tax law, or compliance requirements, but to stay grounded in what good decision-making really requires: discipline, understanding, and humility.

I find these gatherings energizing and deeply rewarding. And I’m grateful for the opportunity to bring that energy and clarity back to our investment management and planning conversations.

P.S. ~ How are you allocating time to growth, personally or professionally? I’d love to hear what’s been inspiring you lately.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation