Crafting Your Couple’s Money Philosophy

When Two Stories Meet One Financial Life

In one episode of the show Friday Night Lights, a married couple, Tami and Eric Taylor, face a quiet disagreement. Tami has just been offered a career-defining opportunity. It’s meaningful work, but it comes with a cost: dipping into savings and shifting the family routine. Eric, her husband, isn’t sure it’s the right time.

There’s no dramatic fight. Just a subtle tension—two people who love each other, each trying to do what they believe is best, realizing:

We see this differently.

Even if you’ve never seen the show, the moment is familiar. Most couples eventually face a decision where money becomes more than a number. It reflects priorities, identity, trust, and timing.

And it forces a question:

Are we aligned on how we want to live, and how money can support that shared lifestyle?

From Mine to Ours: A Financial Move-In Day

When couples combine their lives, it’s easy to focus on the logistics: joint accounts, budgeting tools, credit card bills. But the real work is deeper.

Each partner brings their own system, shaped by experience, habits, and sometimes necessity. One may have tracked every dollar since college. The other may never have needed a budget. One might carry anxiety around spending. The other sees money as a way to enjoy the moment.

Coming together financially is a lot like moving into the same house when both of you already own everything.

Two coffee makers. Two sets of dishes. Two comfort zones learning to overlap.

Do you keep it all? Let go of some? Or use this as a chance to start fresh with something built intentionally for the life you want now?

Just because something worked before doesn’t mean it’s what will carry you forward. What matters is deciding, together, how to shape your financial life from here.

Why the Way You Talk About Money Matters More Than How You Split It

Couples often start with logistical questions:

- Should we merge all of our accounts or keep some separate?

- How do we split expenses?

- Who’s going to be “in charge” of managing the bills?

Those are important. But they’re second-order decisions.

The first question is this:

What kind of life are we building together, and how can our money support it?

Without that clarity, even small decisions can feel loaded. A splurge may seem selfish. A new savings account may feel secretive. What’s really missing isn’t control, it’s connection.

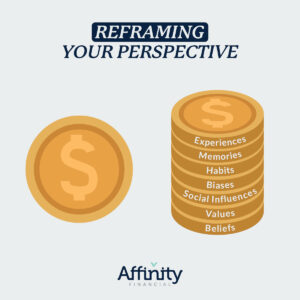

Money Is a Mirror

How we approach money often reveals far more than income or preferences. It reflects identity, culture, and emotional history.

- A partner who double-checks every transaction might be seeking the control they didn’t grow up with.

- A spouse who avoids talking about money might associate finances with stress, judgment, or scarcity.

- One might want to help family members financially due to cultural expectations. The other might worry about protecting shared goals.

These aren’t just differences in money habits. They’re insights into how each person has learned to survive, succeed, and feel safe.

When couples start to explore where their beliefs come from—not to critique them, but to understand them—they often find deeper empathy. You don’t have to agree on everything. But when both partners feel heard, money becomes less of a fault line—and more of a foundation.

Don’t Wait for Something to Be Wrong

Most couples talk about money when they have to: when something breaks, when something’s due, or when someone is upset.

But those conversations tend to be reactive. And reactive conversations often come with tension, not teamwork.

When couples create space to talk about money before there’s a problem, something shifts. You’re no longer responding to stress, you’re imagining possibility. You’re asking:

How can our money support the life we want to build together?

This is what separates coping from planning. It’s how money moves from being a source of friction to an opportunity for clarity and connection.

A Simple First Step: Have a Money Date

This is not a spreadsheet review or bill-paying task assignment.

We are talking about a real conversation—rooted in curiosity, values, and partnership.

Set aside time with your partner. No screens, no pressure, just space to be curious.

Tools like the Money Date Conversation Cards from our friends at ModernHusbands.com can help reveal more about your partner than a decade of dinner table small talk.

Here are a few sample conversation starters:

- What’s your earliest memory of money, and why does that stand out to you?

- Were your parents spenders or savers? How does that influence how you think and act with money?

- What do you enjoy spending money on the most? Please share some specific examples.

- Which would you prefer, a 10% increase in household income or a 10% increase in the amount of time you can spend with family and friends?

- What does a day in our retired lives look like to you?

The most important thing is showing up, open and without judgment.

👉 Get the Money Date Conversation Cards 👫💬

Putting Your Shared Money Philosophy Into Practice

This process is meant to bring clarity, connection, and teamwork into how you manage money together. Don’t worry about getting it perfect, simply aim for an honest and encouraging conversation.

Before you dive in, be sure to schedule a dedicated 45-60 minute Money Date. This is protected time: phones down, intention up.

Step 1: Reflect Individually (Before Your Money Date)

Each of you should spend 15–20 minutes on your own with the following tools:

👉 Take the Financial Compatibility Quiz 💑📝

👉 Explore the Financial Purpose Workbook 📖✨

Bring your completed responses to the Money Date.

Step 2: Connect as a Team (45-60 Minute Pre-Scheduled Money Date)

Pick a relaxed time and setting, free of distractions or devices.

Statement of Financial Purpose Examples:

- “Money’s purpose in our life is to create stability for our kids and give us the freedom to explore.”

- “What financial success means to us is working because we want to, not because we have to.”

- “True wealth is experiences > things.”

Short-Term Goal Examples:

- Pay off $4,200 in credit card debt in 10 months by making $420 monthly payments, giving us breathing room and momentum.

- Save $6,000 in a joint emergency fund by setting aside $500/month over the next year—so we feel secure even if something unexpected comes up.

- Plan and fully fund a weekend trip to Santa Barbara next spring, setting aside $300/month into a “fun experiences” account.

Long-Term Goal Examples:

- Buy a home in the next 3 years with a $300,000 down payment saved, so we can feel rooted and build long-term equity together.

- Save $40,000 for future education needs over the next 10 years, starting with $250/month into a 529 plan.

- Create financial flexibility for career transitions by saving 6–12 months of living expenses over the next 5 years—so either of us can step back, retrain, or explore something new without panic.

Clear & Actionable Next Step Examples:

- Set up an automatic transfer of $500/month into our joint investment brokerage account by the end of this week, starting with our next paycheck. Spend 30 minutes together this weekend reviewing all monthly subscriptions and cancel at least one service we no longer use.

- Add a 45-minute financial check-in to our calendar on the first Sunday of every quarter, starting next month, to track progress on our shared goals.

- Create a “no judgment” spending dollar amount (e.g., $150) that either of us can spend without needing to consult the other, and write it down in our shared notes by tonight.

You don’t have to solve everything at once. In fact, you’re not supposed to. The real win is starting a conversation you can return to—one built on empathy, clarity, and shared purpose.

If things get tense, that’s okay. Try stepping back, taking a breath, or using phrases like:

- “Can we zoom out? I know we’re on the same team here.”

- “What would someone we both respect do in this moment?”

- “Let’s pause and revisit this tomorrow.”

This isn’t just financial planning. This is relationship building.

Yours, Mine, and Ours: Three Models, One Goal

After defining your values and creating a shared financial purpose, it’s time to design a money system that works in service of your life, not the other way around.

Every couple eventually settles into a structure for managing shared finances.

Here are the most common structures, each with its own strengths and tradeoffs.

1. Separate (“Yours and Mine”) – Each partner manages their own money

Pros: Flexibility and autonomy, which can be helpful for couples with prior assets or differing financial backgrounds.

Challenges: Can create distance or avoid important conversations. Ultimately, your partner’s finances affect your life too.

2. Combined (“Ours”) – All income and expenses are shared

Pros: Simplicity, clarity, shared goals.

Challenges: Potential tension if priorities differ and communication is lacking.

3. Hybrid (“Yours, Mine, and Ours”) – A blend of joint and personal accounts

Pros: Encourages shared responsibility while allowing for personal freedom.

Challenges: Requires clear agreements and ongoing communication.

There’s no universal best answer. The right structure is the one that reflects your values, your priorities, and your stage of life. And like most things in marriage, it may need to evolve over time.

Money as a Tool, Not a Trigger

It’s about direction and building something together.

When couples take time to understand each other’s financial story—and shape a shared one—they don’t just manage money more effectively. They build trust, alignment, and a stronger foundation for whatever comes next.

Couples with healthy money relationships don’t just say: Here’s how we budget.

They say: I see you, I trust you, and I want to build this life with you.

Money doesn’t have to be the hard part. With intention, it can become one of the most powerful ways you grow together.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation