The Guardrails Strategy: A Smarter Approach to Sustainable Retirement Income

Imagine cruising down a scenic highway, the sun warming your face and the wind brushing past. The road twists and turns, with steep cliffs on one side and rocky terrain on the other. You’re not inching forward in fear or recklessly speeding ahead. You are solidly in control and driving with ease, knowing guardrails are there to keep you safe. Guardrails don’t restrict your journey; they ensure you arrive safely and while enjoying the ride. You are free to drive with confidence, knowing that while you have flexibility in your speed and lane position, you’re protected from disaster.

That’s exactly what the Guardrails Income Strategy does for retirees. It’s not about rigid rules or reckless abandon. It’s about optimizing your savings and investments so you can enjoy retirement without the looming anxiety of running out of money—or the regret of never spending it at all.

The Challenge: Avoiding the Retirement Spending Extremes

Many retirees unknowingly fall into one of two spending traps:

- The Over-Spender – They withdraw too much, too fast, assuming their portfolio will keep up. Then, the market dips, and suddenly, they’re in a financial tailspin.

- The Over-Saver – They live in perpetual caution, hesitant to spend, always afraid that the next downturn will wipe them out. They end up leaving behind more money than they ever needed to save.

Neither of these pitfalls lead to a fulfilling retirement. The Guardrails Strategy helps retirees navigate a balanced path between these two paths, providing confidence, structure, and flexibility.

Turning Your Investments Into a Reliable ‘Retirement Paycheck’

You’ve worked hard, saved diligently, and deserve to enjoy the fruits of your labor.

However, transitioning from growing your investments to withdrawing income can feel overwhelming. Unlike a steady paycheck from work, retirement income feels uncertain—subject to market swings, inflation, and longevity risks.

The goal is to create a robust, reliable, and sustainable income stream—one you cannot outlive. This is your ‘Retirement Paycheck’—a structured way to replace your working income with a steady flow of funds designed to last throughout your retirement years.

The Guardrails Strategy lays the foundation for this paycheck, ensuring you have financial stability while maintaining the flexibility to adjust as life unfolds.

How Guardrails Work

Instead of an outdated, one-size-fits-all withdrawal rule, the Guardrails Strategy creates a dynamic, adaptable framework:

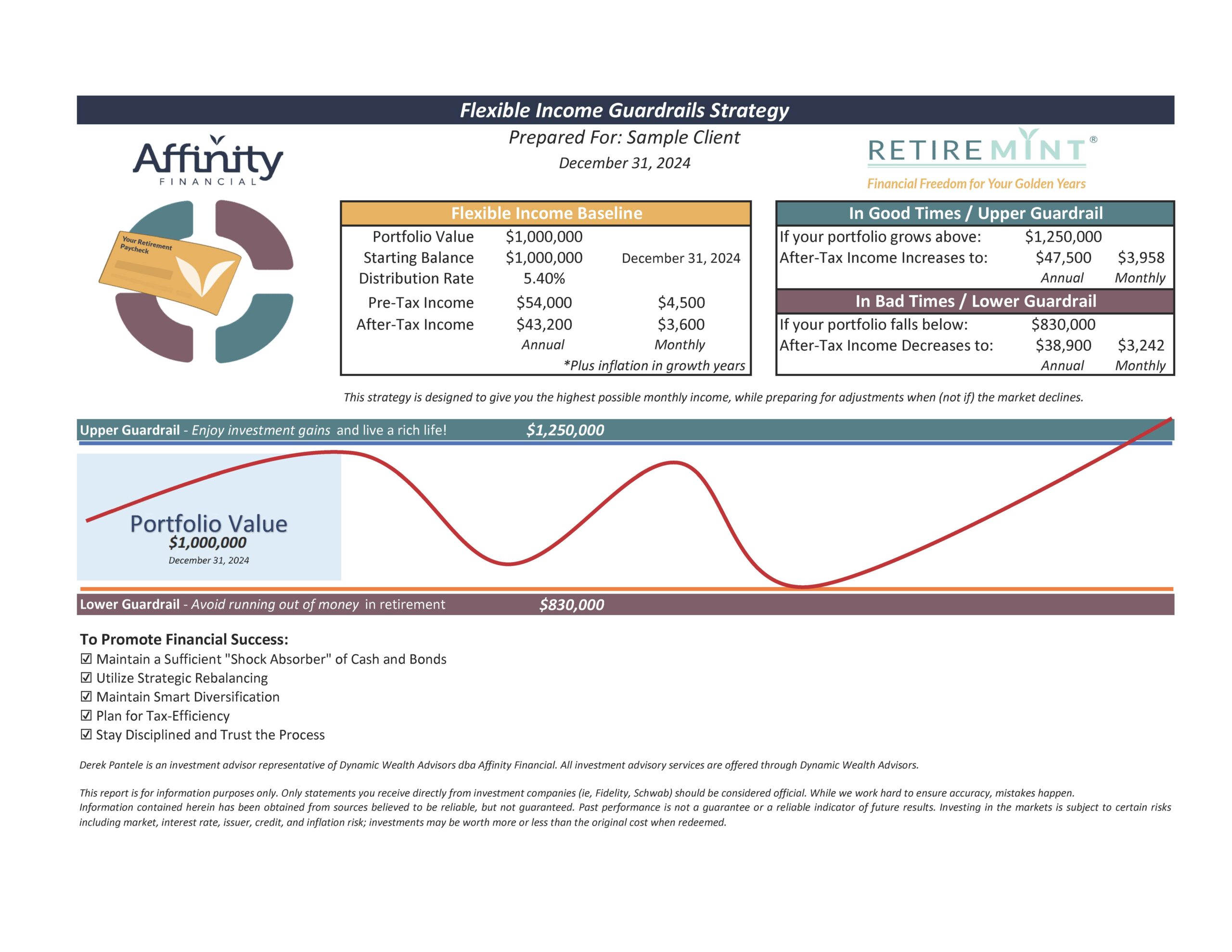

- Set a safe withdrawal rate – Based on portfolio size, risk tolerance, taxes, and time horizon, we establish a sustainable starting point.

- Define guardrails – We establish upper and lower thresholds that signal when an adjustment is necessary. If your portfolio grows beyond an upper threshold, you get a raise. If it declines below a lower threshold, a modest spending reduction can keep things on track.

- Make informed adjustments – Life isn’t static, and neither are your retirement income needs. Guardrails provide structure but allow flexibility to adapt to market conditions, unexpected expenses, and personal needs. The strategy helps you pivot with confidence, ensuring you’re spending wisely without jeopardizing your financial security.

Real-World Examples: What This Looks Like in Action

Example 1: You retire with a $1 million portfolio and begin with a 5.4% withdrawal rate—$54,000 per year. If your investments perform well and your portfolio grows to $1.25 million, your guardrails signal that you can increase your withdrawals. More resources for travel, family, and experiences. But if a market downturn or extra withdrawals shrink your portfolio to $830,000, a slight spending adjustment keeps your plan intact without drastic cuts.

Example 2: A retiree faces an unexpected $30,000 medical expense. Instead of setting off a financial panic, the guardrails framework helps them recalibrate. If their portfolio is above the lower guardrail, they might absorb the cost with little impact. If not, a minor adjustment smooths the impact. No panic, no crisis—just a thoughtful, strategic response.

Why This Matters

A successful retirement isn’t about hoarding wealth or blindly spending. It’s about designing a life you love while ensuring financial longevity. The Guardrails Strategy eliminates the guesswork, helping retirees spend with purpose and confidence.

Because the real goal isn’t just making your money last—it’s making your retirement meaningful.

Are you coasting through retirement with clarity, or are you gripping the wheel in uncertainty? Let’s talk about how the Guardrails Strategy—and the RetireMINT™ framework—can help keep your financial journey smooth, stress-free, and fulfilling.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation