Tax Resources

Retirement Plan Contribution Limits 2023

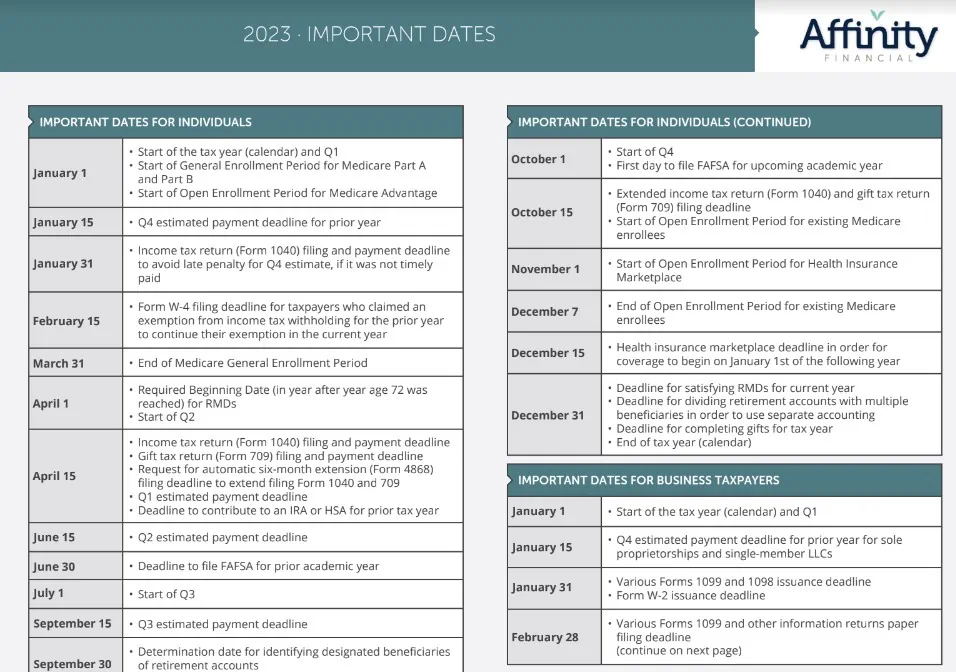

Important Dates 2023

There are many important dates that advisors need to keep in mind. Different contexts and client circumstances will affect applicable deadlines, making it difficult for advisors to identify which figures should be referenced.

In response to this challenge, we’ve created the “Important Dates” resource. This quick reference guide covers the key dates and milestones that are commonly referred to during the year. It includes:

- Tax filing deadlines for individuals and businesses

- Tax payment deadlines for individuals and businesses

- Tax form issuance deadlines

- Retirement plan deadlines

- Common enrollment periods

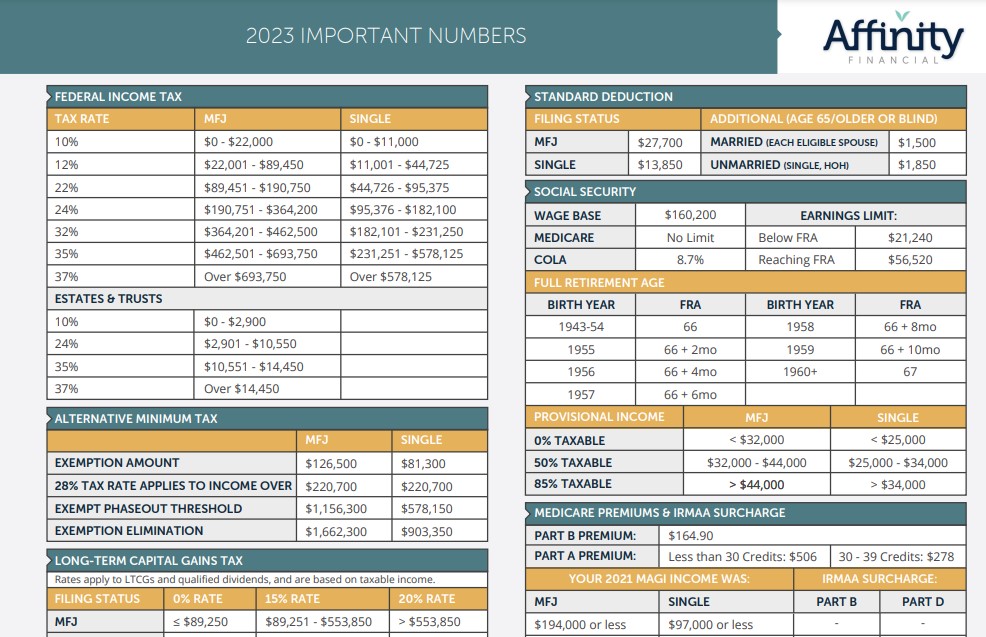

Important Numbers 2023

There are lots of important numbers that advisors need to keep in mind. In some cases, those numbers are annual limits that change each year. Other times, the figures do not often change but are used frequently. Given the variety of sources that report relevant numbers, it can be difficult to quickly find the right reference during a client meeting.

In response to this challenge, we’ve created the two-page “Important Numbers” resource. This quick reference guide covers the most important annual limits as well as figures that are commonly referred to during the year. It includes:

- Tax rates for MFJ, Single, and Estates/Trusts

- AMT annual limits

- LTCG rates for MFJ, Single, and Estates/Trusts

- Standard deductions for MFJ and Single

- Social Security annual limits (including earning limits)

- Full Retirement Age chart

- Social Security taxation summary for MFJ and Single

- IRMAA surcharges

- Retirement plan annual limits

- Traditional and Roth IRA annual limits

- Education tax credits

- Uniform Lifetime Table (abbreviated version)

- Single Lifetime Table (abbreviated version)

- Estate and gift tax annual limits

- HSA annual limits

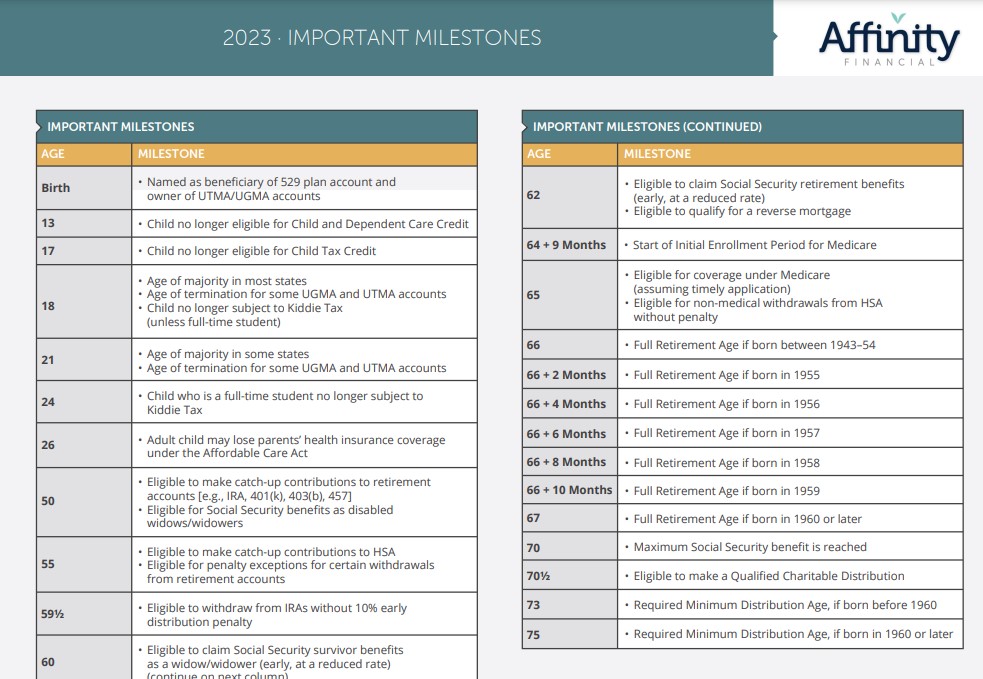

Important Milestones by Age

There are many important age-related milestones that need to be kept in mind. Eligibility requirements often depend on a year of birth, residency, or other personal circumstances.

In response to this challenge, we’ve created the “Important Milestones” resource. It covers ages that affect:

- Child-related income taxation

- Catch-up contributions

- Retirement plan withdrawals

- Medicare

- Social Security

The 6 Hidden Tax Savings Opportunities

Even if you’ve already examined how the 2017 Tax Cuts and Jobs Act and the 2019 SECURE Act have changed the tax rules, we recommend you read this free tax savings guide that breaks down 6 “hidden” opportunities to help you save every penny you can.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation