Tax Planning for High-Earners: Three Strategies to Strengthen Your Financial Flexibility

Three-Part Series Overview

Part 1: Foundational tax-planning principles (Tax-Savvy Wealth Guide Principles 1–3)

Part 2: Income, equity, and complexity for ambitious professionals (Tax-Savvy Wealth Guide Principles 4–6)

Part 3: Retirement, legacy, and multigenerational planning (Tax-Savvy Wealth Guide Principles 7–9)

At a Glance: The Principles Covered in This Article

If you only read one section, start here.

- Maxing out your 401(k) is a strong foundation, not a complete strategy.

High-income professionals often need additional layers to create liquidity, flexibility, and long-term tax control. - Equity compensation and bonuses require planning before money hits your account.

RSUs, options, and supplemental income can either amplify wealth or quietly trigger avoidable taxes without coordinated timing. - Big income years simultaneously create risk and opportunity.

Under-withholding, AMT exposure, and bracket creep tend to occur when decisions are made reactively rather than on a calendar. - Concentrated stock positions increase both portfolio and tax risk.

Waiting to diversify often raises future tax costs and compounds exposure rather than preserving upside. - Liquidity events deserve one-time precision, not generic advice.

Business sales, stock windfalls, and large grants benefit most from experienced tax coordination before decisions become permanent.

A tax-aware planning approach from Affinity Financial brings these moving pieces together, helping ambitious professionals turn complexity into flexibility instead of friction.

In Part One of this series, Tax Prep vs. Tax Planning: Three Principles to Help You Keep More of What You Earn, we explored the foundational principles of tax planning. We shared ideas that apply to anyone who wants to keep more of what they earn.

This article is the second installment in a three-part series based on Affinity Financial’s Tax-Savvy Wealth Guide and focuses on those who often feel tax impact most acutely: ambitious professionals whose income, benefits, and career growth create both opportunity and complexity.

Today, we shift the focus to those who often feel tax impact most acutely: ambitious professionals whose income, benefits, and career growth create both opportunity and complexity.

High earners don’t just face higher numbers on a tax return. They often face more moving pieces. Salary, bonuses, stock compensation, retirement plans, and liquidity events can all work for you or quietly against you, depending on how well they’re coordinated. Most importantly, because these dynamics unfold throughout the year, not just in April, tax planning becomes far more critical than tax preparation alone.

That’s where integrated planning matters. For professionals navigating fast-moving careers, the goal isn’t simply to save more—it’s to build flexibility, reduce blind spots, and make sure each financial decision supports the bigger picture. The following principles—numbers four through six of the nine outlined in Affinity Financial’s Tax-Savvy Wealth Guide—are designed to help you do exactly that.

👉 4. Maxing Your 401(k) Is Smart, but It’s Not Enough

Expand your strategy beyond salary deferrals to build flexibility and future tax control.

Pre-tax and Roth 401(k) contributions are a powerful tool for wealth building. If you’re consistently maxing out your 401(k) with a company match, you’re already doing more than most. But on its own, the salary deferral limit is unlikely to fund a multi-decade retirement for high-income professionals. If you are stopping here, you’re likely under-saving for the lifestyle you want. Worse yet, you’re missing out on near-term and ongoing financial flexibility.

💡 Smarter Approach:

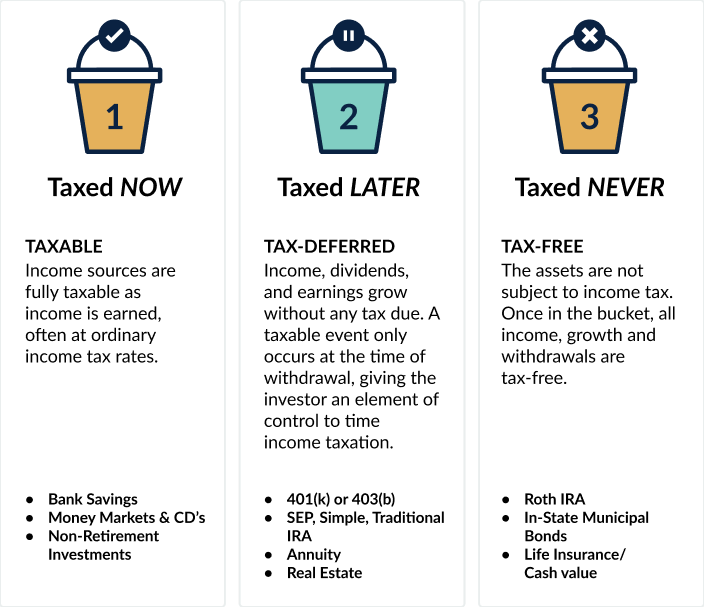

Supplement your 401(k) with after-tax brokerage accounts for life event liquidity, early retirement flexibility, and long-term tax control. Explore layered strategies such as:

- Backdoor Roth IRA for long-term tax-free growth

- Mega Backdoor Roth via after-tax 401(k) contributions

- Health Savings Account (HSA) for triple-tax advantage savings and growth

- Solo 401(k) with profit sharing if you have self-employment income

- Deferred Compensation Plans for corporate execs

This is where working with an advisor who brings real tax experience into the planning process can make a meaningful difference, especially when coordinating multiple account types to create both liquidity and future tax control.

Your 3 Tax Buckets

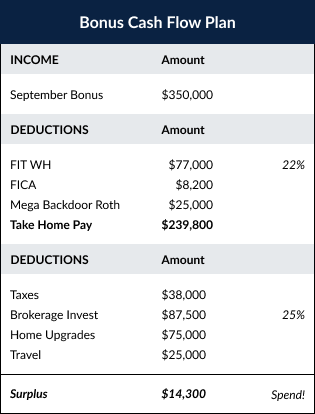

👉 5. Equity Comp and Bonus Income Need a Plan, Not a Reaction

Big income events can mean big tax headaches… or big opportunities

Your RSUs, ISOs, NSOs, and annual bonuses aren’t just “extra pay”—they’re complex, high-impact levers in your tax story. Without a coordinated strategy, they often result in under-withholding, AMT exposure, or missed opportunities for more effective treatment.

⚠️ Common Pain Points:

- Tax surprises, penalties, or interest due to poor withholding on supplemental income

- Exercising ISOs and creating unnecessary AMT exposure

- Failing to factor in taxes due at exercise on NSOs for privately held and illiquid company shares

- Dismissing the power of an 83(b) early exercise to lock in favorable tax treatment on Qualified Small Business Stock (QSBS)

- Selling at the wrong time and pushing into higher brackets or surcharges

🎯 Planning Opportunity: Build a calendar-based equity plan that aligns with your broader tax year strategy. Review withholdings quarterly, anticipate liquidity events, and proactively coordinate with your tax team to preserve more of what you earn. Because equity compensation is one of the most misunderstood areas of personal finance, having an advisor who understands both the investment impact and the tax implications can prevent costly mistakes before they happen.

👉 6. Managing Concentrated Stock or Liquidity Event? Get Tax-Smart About Diversifying

You can diversify and do well with less tax pain.

It’s common to feel stuck with a prominent position in company stock or after a business sale: “I don’t want the tax hit,” is one of the most common reasons people delay taking action. Unfortunately, waiting can quietly increase both risk and taxes over time.

A well-timed, coordinated strategy can help you diversify with purpose, reducing exposure, smoothing out tax impact, and aligning your portfolio with your long-term goals.

If you’re sitting on highly appreciated company stock from RSUs, ESPP, stock option exercise, or a closely held business, diversification can feel daunting. Fortunately, there’s a smarter way. Investors can reduce taxable income and improve long-term financial outcomes through coordinated planning.

When approached thoughtfully, diversification isn’t a sacrifice of potential—it’s the next evolution of your financial freedom.

🧠 Planning Tactics for Tax-Smart Diversification:

- Direct indexing or tax-aware long/short strategies to maintain growth objectives while offsetting capital gains

- Charitable donations of appreciated stock or Donor Advised Fund (DAF) contributions

- Qualified Opportunity Zone Fund to defer and reduce capital gains tax on a sizable business, stock, or real estate sale

- Solo 401(k) or Cash Balance Plan to offset self-employment income

- Optimizing business structure and income for Qualified Business Income (QBI) deduction

Liquidity events and concentrated stock decisions are often once-in-a-career moments. Working with someone who has navigated the tax side of these decisions for years can help you avoid irreversible missteps and protect the wealth you’ve worked hard to build.

Your Next Step: See Where Your Strategy Stands

Tax planning works best when you understand how each part of your financial life fits together. Affinity Financial’s Tax Awareness Self-Reflection Survey helps ambitious professionals identify strengths, uncover gaps, and evaluate whether their current approach fully supports their goals. It’s built around Affinity Financial’s years of experience integrating tax strategy into real-life planning decisions.

If you’re earning well, saving aggressively, and building momentum in your career, this simple assessment highlights how aligned your financial decisions are with tax-smart planning—and where thoughtful strategy may strengthen your long-term outcomes.

Take the survey and get immediate insight into your tax-planning readiness.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation