Why the Right Investment Plan Starts With Understanding Risk

The Rollercoaster Clicks Upward

You’re buckled in. Your palms are sweaty. The cart inches higher. You knew this was coming, but your stomach didn’t get the memo.

And then—whoosh.

You drop. Your heart races. A scream escapes. And just as quickly, you’re climbing again.

Now here’s the strange thing: You paid for this.

Not only did you expect the drop—you chose it.

Because you knew what it came with: the thrill, the momentum, the payoff. The ride.

But imagine if no one told you there would be a drop.

Imagine if the first dip felt like a malfunction, a betrayal.

You’d unbuckle at the next stop and never ride again.

Which brings us to investing.

The Confusion Around Risk

We’ve been taught—wrongly—that risk is volatility.

That a dip in the market means something broke. That if our portfolio falls, it means we’ve done something wrong.

But that’s not risk.

Risk is not the uncomfortable moment. It’s what we do because of the discomfort.

In investing, risk is the possibility of permanent loss, or—more subtly—any decision that reduces the probability of reaching your goals.

So how do we protect against real risk?

It starts by understanding how to build investment portfolios—and a mindset—that helps you stay in your seat for the full journey.

Protecting Against Permanent Loss

The word “loss” gets thrown around a lot. But it’s important to distinguish between temporary declines and permanent losses.

Temporary declines happen all the time. They’re part of the ride.

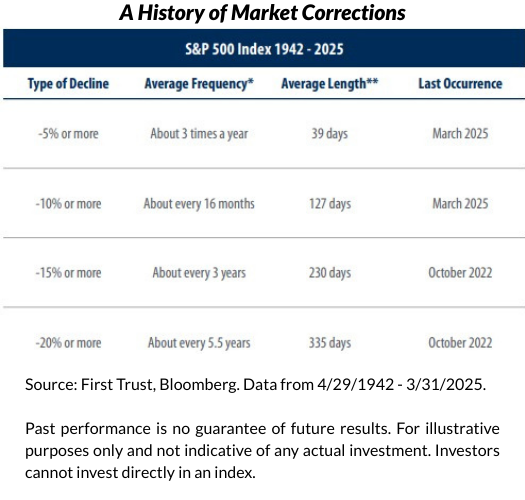

In fact, history shows that the U.S. stock market experiences a drop of 10% or so about every 16 months.

Permanent loss, however, usually happens in one of three ways:

- Concentrated bets that fail

- Emotional decisions at the wrong time

- Selling long-term investments to cover short-term needs

The antidote?

Diversification. Discipline. Liquidity.

Build a resilient and intentional portfolio that:

This is how we shift from reacting to preparing.

This is how we avoid turning temporary discomfort into permanent damage.

Increasing the Probability of Reaching Your Goals

This is the heart of true investment strategy.

Because it’s not about beating the market—it’s about funding your life.

You don’t need the highest return. You need the right return—the one that supports your retirement, your family, your dreams.

That means:

Making good investment decisions isn’t about prediction.

It’s about alignment.

And alignment requires clarity—on your goals, your time horizon, and your tolerance for discomfort in service of something greater.

The Real Challenge: Uncertainty

The hardest part of investing isn’t the math.

It’s the not knowing.

Ask anyone who’s waited for medical test results: sometimes the waiting is worse than the diagnosis.

Why? Because when you know what you’re dealing with, you can make a plan. But when you’re stuck in limbo, your mind fills in the blanks—and rarely with optimistic answers.

Think about checking your 401(k) during a market dip.

You see your balance drop, and suddenly you’re asking:

- “Is this just a normal pullback? Or the start of something worse?”

- “Should I move to cash?”

- “Am I going to be okay?”

We don’t panic because of the drop itself—we panic because we don’t know what’s next.

That’s why emotional preparation matters just as much as financial preparation.

When you expect market drops—when you accept that they are part of the process—you stop treating them like emergencies.

You start treating them like inclement weather conditions: inconvenient, sometimes unpleasant, but something that is manageable.

🧭 Want to Know Your Investment Risk Profile?

Understanding how much volatility you can handle isn’t a guessing game—it’s something we can measure.

Fortunately, there is a simple, science-backed Risk Profile Questionnaire that helps uncover your:

- Risk Capacity – How much risk your financial situation can support

- Risk Tolerance – How much risk you’re comfortable taking, and

- Risk Composure – How you’re likely to react during turbulent times

This 5-minute quiz provides a three-dimensional picture of your unique risk personality. It helps ensure your investment strategy is properly aligned—not just with your goals, but with you.

👉 Take the 3D Risk Profile Questionnaire here

The Emotional Side of Risk: Riding the Real Rollercoaster

If investing sometimes feels like an emotional rollercoaster, that’s because it is.

Markets move—but so do we. Emotionally.

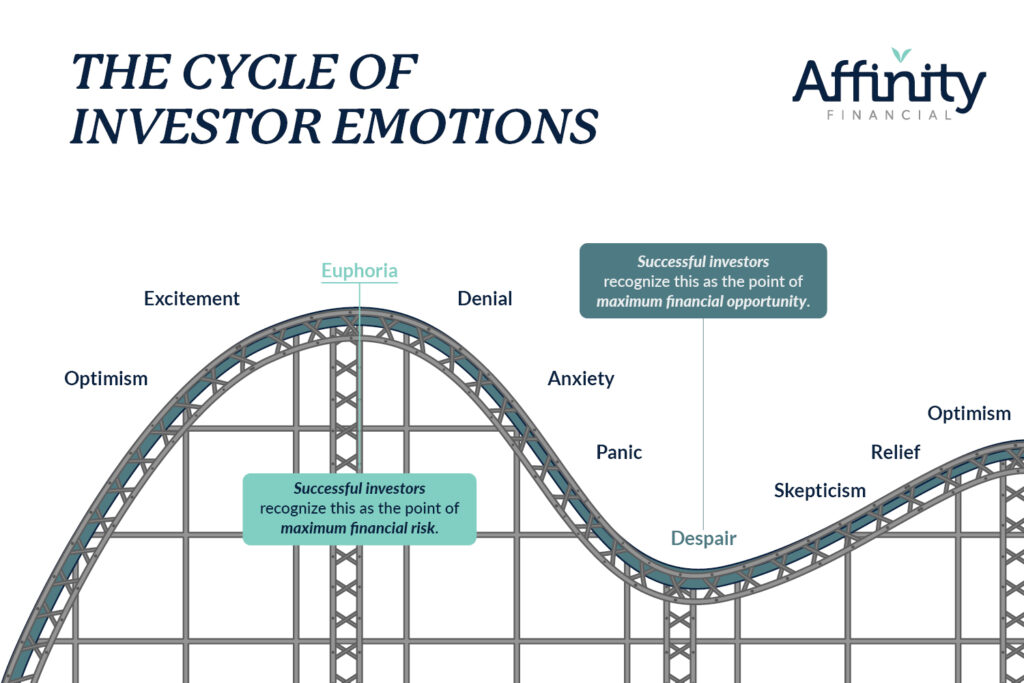

There’s a well-known pattern called the Cycle of Investor Emotions that maps the highs and lows many people experience as markets rise and fall:

Optimism → Excitement → Euphoria → Denial → Anxiety → Panic → Despair → Skepticism → Relief → Repeat.

At the top of the cycle, when everything feels easy, we tend to forget about risk.

At the bottom, when fear takes over, we forget about opportunity.

This emotional loop is why investors often buy high and sell low—even when they know better.

And that’s not a knowledge problem. It’s a behavior problem.

Smart investors recognize this pattern before they’re in the middle of it.

They build systems to reduce the chances of emotional decision-making.

And they prepare mentally—not to avoid the emotions, but to avoid being ruled by them.

In short, they build their strategy with the understanding that the biggest risks often aren’t external.

They’re internal.

Why Markets Swing

Markets don’t just move randomly. They move in response to new information.

Prices in the market reflect the collective expectations of millions of investors, all trying to make sense of what the future holds. When new information shows up—whether it’s a jobs report, a shift in interest rates, geopolitical news, or a surprising earnings release—the market adjusts.

This is the essence of the Efficient Market Hypothesis:

Prices move because investors are constantly processing new data—and adjusting their expectations accordingly.

Sometimes the information is big and obvious.

Other times, it’s subtle or unexpected. But the result is the same: a constant stream of recalibrations that make markets feel like they’re swinging.

That swing can look chaotic in the short term. But in reality, it’s a reflection of how fast and efficiently the market processes uncertainty into updated prices.

And while the market doesn’t always get it right immediately, it’s remarkably good over time at reflecting what we know—and what we expect.

That’s not randomness.

That’s responsiveness.

Want to Avoid Panic? Prepare for It.

Smart investors aren’t fearless. They’re ready.

Preparation isn’t about knowing exactly what the market will do next—it’s about having a framework that keeps you steady when things get noisy. Here’s what that looks like in real life:

✅ Limit your news intake – Stay informed, but don’t drown in headlines. Most financial media is built to grab your attention, not help you make better decisions.

✅ Build a cash cushion – Having 3–12 months of cash for known expenses isn’t just smart—it helps you avoid selling long-term investments at the wrong time.

✅ Match money to time – Short-term needs? Keep it stable. Long-term goals? Stay invested.

✅ Diversify across the board – Countries. Sectors. Asset classes. Don’t rely on a single story.

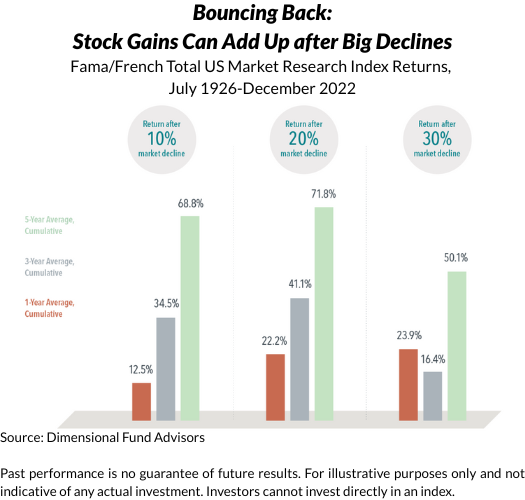

✅ See the opportunity – Lower prices often mean higher future expected returns. Since 1926, the Total U.S. Market has averaged a 1-year cumulative return of 22.2% following a 20% market decline. Keep your contributions going, and if you have excess cash, this might be a time to lean in.

✅ Remember your goals – Investing isn’t just about returns—it’s about what those returns make possible.

✅ Control what you can – Markets can be unpredictable in the short-term. Put your effort into control of your savings rate, your tax strategy, your behavior, and how well your plan is aligned with your goals.

✅ Lean on your plan – Your financial plan should already account for volatility. If you’re feeling uncertain, stress-test your assumptions. You might be more resilient than you think.

Not All Adjustments Are Emotional

There’s a difference between reactionary changes and intentional adjustments.

Not all change is bad. The right change, at the right time, for the right reasons, can keep your plan on track.

Rebalancing your portfolio, reviewing your timeline, harvesting tax losses—these aren’t signs of panic. They’re thoughtful tools that can strengthen your plan during volatile periods and potentially lead to improved long-term outcomes.

The key is knowing the difference between reacting out of fear and responding with purpose.

How to Deal With Uncertainty: The Framework Matters

Uncertainty can be uncomfortable.

And when discomfort builds, people often freeze—or act impulsively.

But there’s a better way.

- Education – Start with Understanding

- Knowledge – Turn Understanding into Clarity

- Action – Align Behavior with Belief

Smart investors don’t wait for perfect clarity.

They learn how markets work. They understand their personal plan. And then they take informed action based on logic, not headlines.

Many investors fail not because of a lack of intelligence, but because they lack a clear framework to filter out noise.

But here’s what history shows:

- Innovation has never failed to produce growth and profits over time. The world moves forward. And markets, ultimately, reflect that.

- Fear causes short-term sell-offs, but it rarely reflects the long-term value of strong businesses.

- It rarely feels like a good time to invest—but more often than not, it is. Especially if you’re investing in quality companies at reasonable prices.

You don’t need to predict the future to be a successor investor.

You do need a process, a plan, and the willingness to follow them when it matters most.

What You’re Actually Paying For

When people say they want to avoid volatility, what they’re often really seeking is certainty.

And that’s completely understandable.

But in investing, certainty is expensive—and often an illusion.

Volatility isn’t a penalty. It’s the cost of admission paid to earn the rewards of long-term growth.

It’s the price of participating in innovation of business, the compounding of earnings, the expansion of the global economy over time. Without the ups and downs, there wouldn’t be any reward. No premium for staying invested. No payoff for discipline.

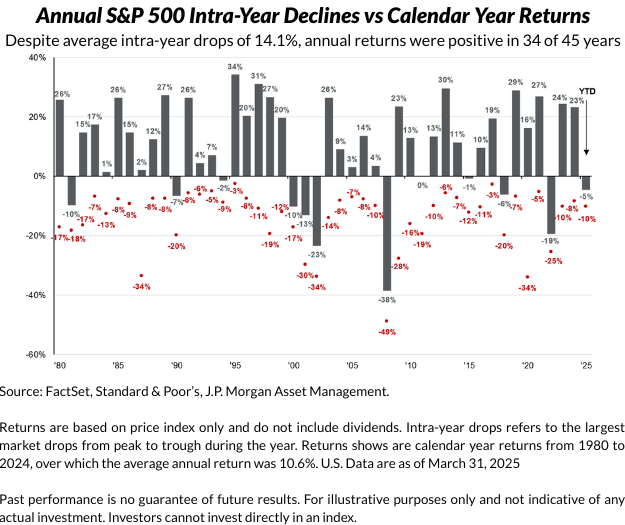

Since 1980, despite an average intra-year drop of 14.1%, the market has ended the year in positive territory about 75% of the time.

If you’ve already been investing—if you’ve ridden out bear markets, stuck with your plan, resisted the noise—then here’s something important to remember:

You’ve already paid part of the price. Don’t leave before you collect the return.

Selling in a panic is like wishing you could exit a plane mid-flight because you hit turbulence.

Remember: You bought the ticket. You packed your bags. You boarded the plane—for a reason.

You’re headed somewhere important. A place you chose. A destination that matters.

Yes, the ride gets bumpy sometimes. But turbulence isn’t a reason to cancel the trip—it’s something pilots and passengers plan for.

The investors who reach their goals aren’t the ones who avoid all turbulence—they’re the ones who stay buckled in, trust the process, and stay focused on where they’re going.

In the End, It’s Not About Being Brave—It’s About Being Ready

Be honest about what markets do.

Be honest about what you need.

Be honest about what kind of investor you want to be when the ride dips and twists.

Because you can’t have the rewards of the market without the ride.

But you can choose how you experience it.

So next time the cart rattles and the sky dips—hold on.

You’re experiencing turbulence, but that doesn’t mean something is wrong.

Look to the horizon.

Remind yourself why you got on the ride in the first place.

Long-term goals take time, resilience, and a steady hand.

The journey may not be a straight line—but you’re prepared.

And you don’t have to navigate it alone.

That’s why we’re here—to help you stay grounded in your plan, adjust when needed, and stay focused on what matters most. Whether you’re feeling confident or concerned, we’re here to walk alongside you—every step of the way.

Get the Affinity Insider in your inbox

We respect your privacy and promise to keep your information safe.

EXPLORE TOPICS

Start Your Next Chapter and Pursue Exciting Financial Goals

Click below and schedule a complimentary consultation